Looking for the best Payper Inc casinos in Canada? You’re in the right place. Payper Inc is a trusted Canadian payment processor used by top brands like Grand Mondial and Luxury Casino for instant deposits and fast cashouts — without the chargeback drama. Below you’ll find our curated list of verified Payper casinos for 2025, all offering secure Interac-style transfers.

Top 3 Canadian Casinos Accepting Payper Inc Deposits (2025)

- Instant Payper Inc deposits starting from just C$10

- 150 chances for C$10 · Licensed by the Kahnawake Gaming Commission & MGA

- Operated by the Casino Rewards Group · Fast Interac e-Transfer payouts

- Supports Payper Inc, Interac Online & eCheck deposits

- Welcome bonus up to C$1,500 · Trusted Casino Rewards brand

- Licensed by Kahnawake & iGaming Ontario for Canadian players

- Fast Payper Inc deposits via Interac e-Transfer®

- 150 spins for C$10 · Same-day withdrawals for verified accounts

- Part of the Casino Rewards network with Kahnawake oversight

All three sites are part of the Casino Rewards Group and fully licensed under the Kahnawake Gaming Commission and MGA. Their integration with Payper Inc ensures instant Interac-style deposits and low chargeback risk — a major advantage for Canadian players seeking fast, secure payouts in 2025.

Mini-Reviews of the Best Payper Inc Casinos in Canada

Canadian players using Payper Inc for online deposits have several trusted options operated by the Casino Rewards Group. Below are our top three performing Payper-enabled casinos for 2025 — each licensed by the Kahnawake Gaming Commission and integrated with Interac e-Transfer® for fast, secure transactions.

1. Grand Mondial Casino — Best Overall Payper Inc Casino for Instant Deposits

Grand Mondial Casino ranks first for near-instant Payper Inc deposits, consistent payout reliability, and dual oversight (Kahnawake, MGA). Players can start from C$10 and claim 150 chances to win for C$10. In our tracking, Grand Mondial shows very fast Interac approval times and low friction in the cashier, making it the benchmark Payper experience under the Casino Rewards Group.

2. Golden Tiger Casino — Top Payper Casino for Bonuses and Loyalty

At Golden Tiger Casino, Payper Inc integration delivers quick Interac-based payments with added flexibility via eCheck and Interac Online®. Licensed by Kahnawake and iGaming Ontario, this long-running Casino Rewards Group brand pairs smooth deposits with a C$1,500 tiered welcome and strong VIP retention — a reliable choice for regular players who value fast cashouts.

3. Yukon Gold Casino — Best Payper Casino for Beginners and Low Deposits

Yukon Gold Casino is a friendly starting point for Payper users thanks to its C$10 minimum, straightforward Interac e-Transfer® flow, and eCOGRA-audited environment. Licensed by Kahnawake, it emphasizes clarity at the cashier and steady same-day processing for verified accounts — ideal for first-time Canadian players trying Payper Inc.

These online casinos were ranked based on strong deposit approval rates, robust licensing credentials, and trusted operation under the Casino Rewards Group. We also considered brand reputation, the availability of alternative payment options (Interac, eCheck), and the presence of responsible gambling tools to ensure safe, transparent play for Canadian users.

Is Payper the Only Way? Why Some Players Look for Alternatives Like Loonio

Wondering if Payper casinos are safe — or just fed up with delays? You’re not alone. Many Canadians Google “Payper Inc”-related terms after getting a confusing payment email or dealing with slow Interac withdrawals. While Payper is legit and widely used, please know it’s not the only option.

A newer service called Loonio, launched in 2022, now powers faster, cleaner Interac e-transfers — often with no delays or confusion.

About Payper.ca

Payper.ca is a fresh face in Canada’s online gambling scene, offering payment solutions built specifically for the high-risk nature of the iGaming industry. Founded in 2020 and headquartered in Toronto, Ontario, Payper quickly established itself as a key player in the casino payments sector. They have been present at most iGaming trade shows as of late, including the Canadian Gaming Summit of 2024, the ICE London 2024 and the Canadian Gaming Summit of 2023. Payper casinos are growing rapidly, with dozens of sites now available through the Casino Rewards family of brands.

What to Look For As Players

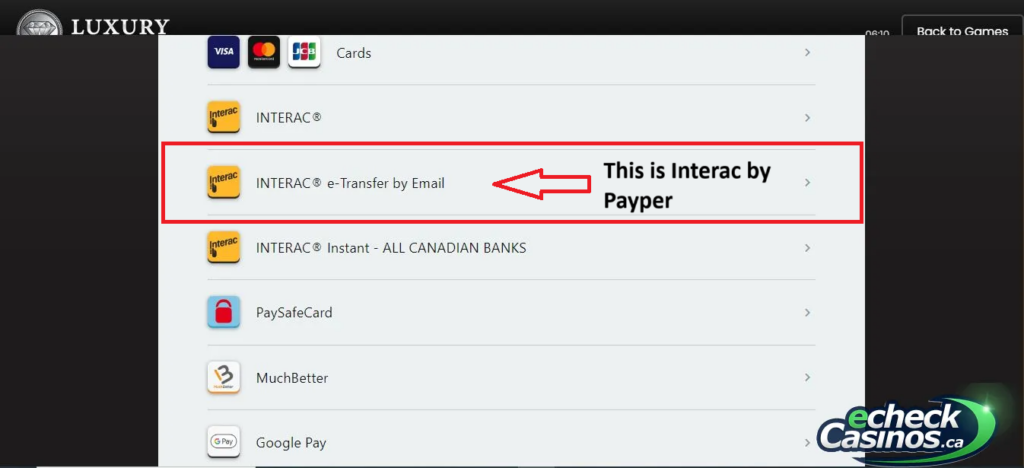

There are dozens of Payper Inc casinos – more than we can list here – so instead of listing them all out, we will teach you how to fish instead. The official wording to look for in the cashier, which typically matches Payper (and not a competitor) is as per the following screenshot.

Please note that the example below is for Casino Rewards’ Luxury Casino. Another pro tip is that Casino Reward brands typically uses Payper, Inc. So choose any site you like within that umbrella. Please know that Pay Direct is also available as an Interac alternative at Casino Rewards.

“With an average of 1 ticket per 10,000 transactions, you might wanna tell your fraud department to bring a book to work”

Source: https://www.payper.ca/why-payper

This low chargeback rate is particularly relevant to the subject of our website, eCheck casinos, because our payment vertical has historically been plagued by fraud and chargeback issues ever since its inception. Just as a physical check can bounce, so too can eChecks, and bad actors trying to abuse the casinos can also initiate a chargeback by contacting their banks (just like using a credit card).

eChecks are more vulnerable because they take up to 7 days to clear so fraud can be applied at any stage of the process and the casino won’t know until later. Also eChecks have less protection than credit cards for chargeback fraud.

This vulnerability is because the eCheck system uses the traditional banking system’s slower processing times, unlike newer payment methods that offer instant or near instant transactions. This delay gives bad actors time to exploit the time gap between the transaction being initiated and being completed. During this time they can do unauthorized activities and leave the casino open to financial loss.

Also eChecks have less chargeback protection than credit cards. Credit cards have built-in fraud detection and consumer protection policies so it’s easier for users to dispute unauthorized transactions. eChecks don’t have the same level of security so it’s harder for casinos to dispute chargebacks.

So when you come across an online gambling payment method that claims 1 fraud ticket per 10,000 transactions, you listen. And if they’re right, and you truly only need to bring a book to work, that would be a game changer for many iGaming site operators.

Payper.ca Core Offerings And Chargeback Discussion

Payper’s primary focus is on providing localized payment options (like Loonio) that resonate with Canadian customers. Their flagship services include:

- Interac e-Transfer®: This widely popular Canadian payment method allows for instant, real-time transfers directly from a user’s bank account. Payper has automated this process, eliminating the need for manual reconciliation.

- Interac Online®: Interac online is a debit card-based payment solution that enables direct transactions from a user’s bank account.

- Online Banking Payment: An enhanced electronic funds transfer (EFT) system that facilitates payments through online banking platforms. Enhanced in the sense that it has anti-fraud features built in compared to a regular EFT. iGaming clients can even set a risk threshold, which is a very nice feature to have.

- Digital Cheque: (an eCheck, which is the subject of our site): An electronic version of a traditional cheque, streamlining the payment process for those accustomed to this method. However as we know industry-wide, this method is particularly susceptible to fraud (not speaking about Payper.ca’s offering in particular).

To us, it seems more iGaming sites should integrate solutions similar to “Online Banking Payment” from Payper.ca, instead of leveraging outdated eCheck solutions. Some eCheck brands we’ve encountered in 2024 (which shall not be named here) have little to no protections built in. Yet they still credit player funds immediately, even before the funds clear.

Some brands like PokerStars are wising up, and players with returns might have to wait for the funds to clear next time. This only makes sense. However most brands will lock a player that had some eCheck returns immediately, if it seems to be malicious in nature. However, if the return is due to other reasons, such as user error, it doesn’t necessitate a ban; it’s handled on a case-by-case basis.

The best eCheck implementations we’ve seen in terms of chargeback protection require a string of 5 preliminary deposits using an APM to first unlock eCheck as a deposit modality. This is a very powerful way to mitigate fraud, for these reasons:

- Buffers Players: Gives the casino ample time to study player depositing and playing patterns

- Studies Players: Machine Learning can be applied to study the betting pattern(s)

- Filters the Fraud: Players less likely to fraud on the 6th deposit

- Powerful Deterrent: Most players with intent to fraud will not want to wait for 5 deposits

The above seems to be the current solution of Cadtree Limited brands. However the flip side of that implementation is that legitimate players looking for eCheck deposits might be deterred by the stringent requirements. So it seems to us that something like Online Banking Payment by Payper casinos (or any similar secured-EFT implementation) would be a great eCheck alternative.

From our GA4 traffic logs, there are certainly a lot of eCheck deposit queries in Google Canada. This clearly shows that there is a niche demographic of players that wants to be catered to. However, that Google traffic also carries the intent to commit fraud. So as an operator, or an affiliate like us, the question is how to parse that traffic effectively. You want to add protections but not deter legitimate players.

It’s not easy. As affiliates, we are always treading a subtle line. We want to be transparent, but we can’t be too transparent. We want to present the best instant eCheck brands, but we are forced to present delayed eCheck brands instead because of the fraud element.

In some cases we might present some eCheck-like APMs, like Instadebit and iDebit because they rely on third parties and so have more anti-fraud measures built-in. In other cases, we will go even further and recommend something completely new to our readers, for example something like UTORG via Skrill, which is a novel deposit implementation alternating between CAD currency and crypto. Funds are auto converted to crypto, deposited, and reconverted to CAD in the player account.

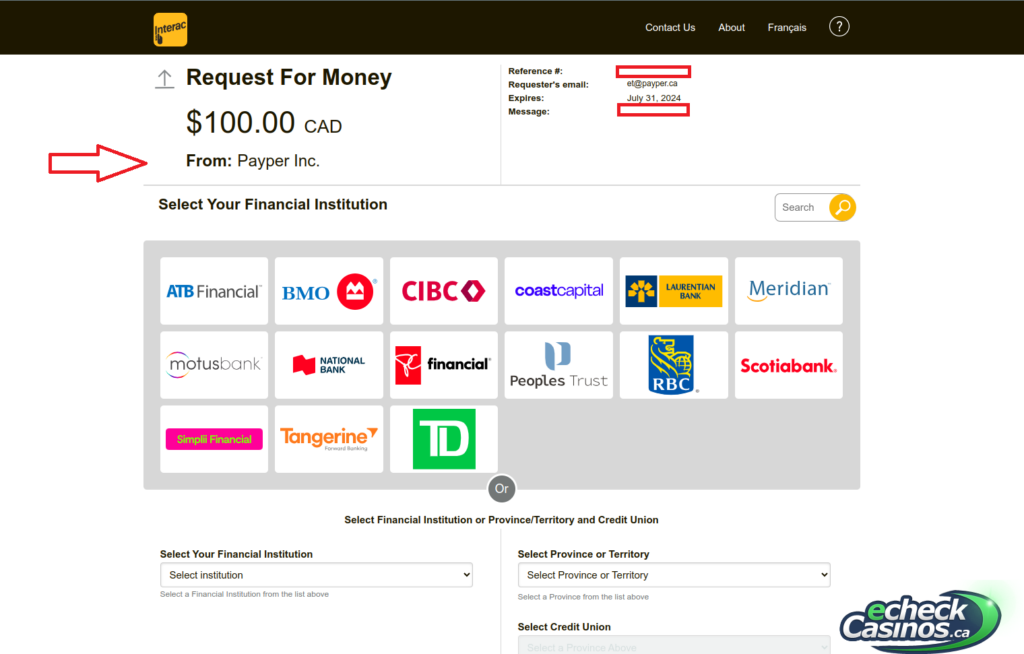

Payper Inc Deposit Process:

The depositing process is somewhat similar to alternatives like Gigadat and Loonio. The biggest differences are the branding, the payment URL gateway you are using, and the user interface process.

In the case of the example above, the payment system leverages Interac’s “Request for Money” rail service. Cues are sent to the user via email, prompting them to approve and populate certain fields in the casino’s payment screen. Similar to the Loonio system, you will have two options to find your financial institution: do a quick visual search with the logos side by side or use the fields below where you can drill down with the address.

The main difference with other Interac implementations is the requester’s email, since this is an email e-transfer service. In this case, for Payper, it is set to et@payper.ca. We masked the reference number in the screenshot, but this is automatically generated in the invoice so your payment has a unique identifier. The last field, payment amount, is self-explanatory.

For the purposes of this demo, you can see we chose 100 CAD, which is typically above the minimum deposit requirements. Submitting starts a payment loop that ties into your bank account, and approving via email closes the loop and completes the transfer. Of note that Payper, Gigadat, and others are typically timed, so if you don’t close the loop in time—in this case 24 hours—your payment will be declined.

Impact on Canadian Gambling Sites

Payper Inc’s solutions are particularly well-suited for the online gambling industry in Canada. Here’s why:

Localization: By focusing on payment methods that Canadians are familiar with and trust (in this case Interac specifically), Payper helps gambling sites increase their appeal to local users. Payper, Inc. is part of the trifecta of companies that players typically encounter when making deposits in Ontario, namely: Wyzia, Gigadat, and Payper. And the brand has become associated with Interac in the mind’s of users, as have Wyzia and Gigadat.

Instant Transactions: The real-time nature of Interac e-Transfers® and other Payper solutions allows for immediate deposits and withdrawals, enhancing the user experience.

Reduced Chargebacks: As we’ve seen earlier, Payper can significantly reduce chargebacks, a significant issue in the gambling industry.

Compliance: As a Canadian company, Payper is well-versed in local regulations, helping gambling sites navigate the complex regulatory landscape.

Stats About User Preferences

Payper’s approach is backed by compelling statistics (which they feature on their site):

- 52% of Canadians would prefer to use an Interac e-Transfer® over a credit card for online transactions

- 65.5% express interest in using Interac e-Transfer® for online purchases

- A staggering 90% of Canadians already know how to use Interac e-Transfer®

Source (Payper.ca, just below the fold)

These figures underscore the potential for Payper’s solutions to drive adoption and user satisfaction in the online gambling sector.

Integration and Flexibility

One of Payper’s key selling points is its ability to integrate with existing payment infrastructures, offering a proverbial plug-and-play solution. Gambling sites can add Payper’s solutions without discarding their current credit card merchant accounts, allowing for a gradual transition or a hybrid approach. Most brands we’ve encountered serving the Canadian market focus on a hybrid model, with these categories typically represented.

- Ewallets (and modern implementations like MiFinity)

- Credit and debit cards

- Interac (either via Loonio, Gigadat, Payper, or others)

- Crypto

In general, iGaming brands choose Payper to enhance their EFT offerings and to widen the range of deposit options for their player base.

Payper.ca Advantages

The advantages of this fintech solution are manifold; however, here are some of the obvious ones:

- Its primary selling point is the weekend payment processing. Players can transact via Payper e-Transfer on weekends and public holidays

- Its systems use advanced push payment and ML (machine learning) algorithms to detect and prevent fraud in real-time

- Instant deposits and withdrawals

- Familiar payment methods for Canadian users

- Enhanced security through bank-level encryption

- No need to share credit card information

- Potential for reduced chargebacks

Beyond Gambling: Broader Applications

While Payper’s solutions are indeed particularly advantageous for online gambling sites, their applicability extends to various e-commerce sectors. The company’s focus on reducing friction in the checkout process and increasing conversion rates makes it attractive to any online business looking to optimize its payment systems.

Industry Recognition

Payper’s innovative approach has not gone unnoticed in the iGaming industry. The company has been featured in industry directories and events, including:

- iGaming Suppliers, a comprehensive directory of vendors in the online gambling space

- Canadian Gaming Summit

- ICE London

Future Outlook

Despite its promising start, Payper faces several challenges:

Competition: The payment processing industry is highly competitive, with established players and new fintech startups vying for market share as of late. We’ve seen new ewallets pop up in particular (such as Much Better and eZeeWallet). Crypto has also been making a push, especially with the integration of UTORG with leading ewallets like Neteller and Skrill.

Regulatory Landscape: The online gambling industry is subject to evolving regulations, requiring Payper to stay agile and compliant. The Ontario space regularly introduces new measures, and we’ve seen things like bans on specific deposit options in the UK and Australia. There is significant regulatory volatility in the iGaming space.

Expansion: While Payper’s focus on Canadian payment methods is a strength, it may limit its international growth potential.

Payper.ca cons:

- Limited to Canadian market and Canadian banks

- As a user, it is not easy to research and find iGaming sites that actually use Payper.ca. In the cashiers, all you see is Interac but not the specific implementation. Payper Inc Casinos are not readily documented or accessible on affiliate sites. The only way to truly find out is to log into the individual casino’s cashier and see what Interac versions they are offering. On their homepages, the casino brands will typically display the generic Interac logo and not the specific implementation (Loonio, Payper, Gigadat, etc..)

- Still a niche deposit option, most players are familiar with Gigadat or Wyzia.

- Requires users to be comfortable with using online banking.

- May have transaction limits set by banks.

Security Measures

- Multi-faceted fraud checks

- Machine learning algorithms for fraud detection

- Negative databases to flag potential issues

- Advanced push payment algorithms

User Experience

Payper emphasizes a streamlined checkout process with:

- Focused payment flow

- Reduced redirects

- 96% completion rates for transactions

Comparison with Alternatives (Table)

| Feature | Payper | Credit Cards | E-Wallets |

|---|---|---|---|

| Transaction Speed | Instant | Instant for consumers, 1-3 days settlement for merchants | Instant to 24 hours |

| Chargebacks | Minimal | Common | Low |

| User Familiarity (Canada) | High (Interac) | High | Moderate |

| International Usage | Limited | Widespread | Widespread |

Conclusion

So there you have it… Payper.ca as a whole represents a significant development in the Canadian gambling payment landscape. By focusing on localized, instant, and user-friendly payment solutions, the company is addressing a clear market need. In this case: iGaming deposits without chargebacks. For Canadian gambling sites, Payper really does seem to offer a compelling suite of solutions. Are chargebacks a thing of the past? Only time will tell.

As we said, the coming years will reveal whether Payper can maintain its momentum and establish itself as a long-term leader in this dynamic sector. And whether new forms of eCheck with anti-fraud features can take over our antiquated electronic checks of the past.

Frequently Asked Questions

Who uses Payper Inc ?

Payper Inc is used by online casinos and e-commerce platforms in Canada for fast, secure, and convenient payment processing, primarily partnering with Interac to enhance the transaction experience for Canadian users.

What is a chargeback?

A chargeback is the reversal of a transaction initiated by the cardholder's bank. This involves a user calling his bank to cancel a payment that was already sent. Normally this is due to disputes over fraudulent or unauthorized transactions. In the case of iGaming, a fraudulent player might claim that their account was used for illegal gambling when they were the one who initiated it. This is where there is deception/fraud. In general, the ability to chargeback serves as a consumer protection mechanism. This can pose challenges for merchants, particularly in industries like online gambling where players are trying to take advantage of casino operators.

How does Payper.ca reduce chargebacks?

Payper.ca employs novel and proprietary fraud detection methods, including machine learning algorithms and push payment technology, to minimize chargebacks. They claim very low rates on their website (1 ticket per 10,000 transactions). Their solutions are designed to provide a secure transaction environment for both players and operators.

How does Payper.ca compare to other payment methods ?

Compared to credit cards and e-wallets, Payper offers instant transactions with minimal chargebacks. While credit cards are widely accepted internationally, Payper focuses on the Canadian market with high user familiarity due to Interac integration.

Can you make Payper Inc gambling withdrawals ?

Yes, you can make gambling withdrawals using Payper Inc. However, not all casinos offer Payper as a withdrawal option; some may only accept it for deposits. For those that do support Payper withdrawals, the process is typically quick and secure, often involving methods like Interac e-Transfer, Visa Direct, or Mastercard Send.

Is Payper inc legit ?

The legitimacy of Payper Inc is questioned by some users on platforms like Reddit, where issues with Interac e-Transfers involving Payper Inc and Kraken have been reported. Users have expressed concerns about delayed transactions and poor customer service, leading to doubts about the company's authenticity. However, remember that individual experiences may vary. Payper Inc is known for its innovative payment solutions and commitment to enhancing transaction efficiency and security, making it a trusted choice for many businesses in Canada.

What is the Payper inc email ?

Payper Inc does not provide a direct email address for contact. Instead, they offer a contact form on their website for inquiries about their products and services. Here is the link to their contact page: https://www.payper.ca/contact

Does Payper work with Kraken ?

Yes, Payper Inc works with Kraken by facilitating Interac e-Transfers, allowing users to fund their Kraken accounts. More information here: https://support.kraken.com/hc/en-us/articles/4412259063444-How-do-I-fund-my-account-with-an-Interac-e-Transfer-