They say nothing is free in life, and I’ve found this statement holds up quite well in the world of eCheck gaming. Now, I’m not one of those bonus hunters always looking for freebies, but I do find it a bit unfair that eCheck isn’t available right away in most casino cashiers. What do I mean by that?

Well, if you’re planning to use eCheck, just know it’s no walk in the park. You’ll need to complete KYC, keep your account in good standing with regular activity, make at least three to five deposits, and sometimes even wait through a two-week time gate—all just to unlock the ability to use electronic checks

Why eCheck is Not Available in Your Account

Because of one word: abuse. A few bad actors have made things worse for everyone. By “bad actors,” I mean people who use eCheck to take advantage of casino operators. They make a deposit and then contact their bank to reverse the transaction—this is called a chargeback. This is illegal, mind you, but some still do it for various malicious reasons. They claim the transaction was made without their consent and that they don’t use online casinos. It’s unfortunate because chargebacks are meant to be a legitimate channel for consumer protection when used properly. For example, if someone stole your credit card and made unauthorized purchases, you’d want to be able to reverse those charges.

Because of this, casinos have become extremely strict about offering eCheck to new players. In fact, eCheck and “new player” have almost become an oxymoron.

Why Casinos Are Very Suspicious of eCheck Users

If a new customer demands to deposit via eCheck, casinos immediately become suspicious. This is simply because it’s the method most associated with fraud. They might screen that player and watch their playing patterns to determine the probability of fraud. Most of these players deposit, use their funds, and never come back. This is the one most clearly associated with fraud, as they notice they’ve lost, abandon the account, and then contact their bank to initiate a chargeback.

As Casino Affiliates, We Are Victims of eCheck Fraud Too

As an affiliate, every time we refer a player or customer who charges back, any commissions due to us for that player are reversed. So it’s like money disappears from our account, and from the casino’s too. It honestly makes this job very tedious, as money you think you’ve earned is almost never really yours, since players often charge back. It’s quite depressing sometimes. Here is a case study:

At one point, Spin Galaxy decided to remove the eCheck unlock conditions upfront. This was around the middle of last year. We promoted them to position #2 and had a very high conversion rate, around 60%-70% from sign-up to deposit. We were thrilled to see so many conversions, and we even bumped up their eCheck ease score to the max. However, one after the other, the player accounts were locked in our affiliate dashboard. At the end of the month, on the balance sheet, we had all our commissions taken away in a big minus, which was quite depressing.

I believe out of 11 players we sent to Spin Galaxy, as a case study, 8 or 9 of those charged back. Since our site is based on eCheck, this made our traffic close to 70-80% fraud. Of course, if you send so much fraudulent traffic, no company is going to work with you long term. As such, we stopped promoting instant eCheck deposit sites, and instead now focus on delayed eCheck sites after customers are properly vetted. We also noticed that Spin Galaxy stopped offering eCheck right off the bat because of the rampant abuse.

How to Actually Unlock eCheck (If You Are a Legit User):

Alright, let’s say you’re a legit player—maybe even a high-roller—and you want to cut through the noise and be treated like a real VIP, with eCheck access and an account agent. Well, like anything else, you need to qualify first. In this case, the qualification process will depend on the casino group you choose. In this section, we’ll look at the different eCheck unlock requirements by casino group.

Baytree Limited (most stringent eCheck access requirements)

This is Jackpot City, Spin Casino and others, all part of the Super Group. These sites are really solid, but they don’t make it simple to access eCheck. In fact, you won’t see the eCheck logo at all in the cashier, even when logged in. It’s like it’s hidden so people don’t know about it. However, it’s still there, and it will appear for dedicated players. What do we mean by dedicated?

Players who have played for a while—say, at least two weeks—and who have made anywhere from three (on the low end) to five deposits. Then, they’ll earn the eCheck logo in their cashier as a well-earned surprise. This is really nice to have as a deposit feature, and fiat deposits and withdrawals don’t get any better than that. As you know, Interac by Gigadat and Payper usually have limits of $3,000 CAD at one time, with daily and weekly limits applied.

However, eCheck is really unlocked in terms of limits, making it highly attractive for high rollers. It’s just not so easy to access. Even knowing the information we’re sharing here isn’t common knowledge, and I doubt you’ll see it on other sites. Most other sites just blanket mention casinos that accept eCheck and offer little to no details. In fact, in many cases, they promote sites that don’t even accept eCheck at all.

But know that if you’re a serious and dedicated player, Baytree brands will give you free eCheck access. They are great for that and worth the upfront hassle to access. Please note that Baytree includes Cadtree Limited in Ontario.

Casino Rewards Brands (most lenient in terms of eCheck access requirements)

After speaking with the affiliate manager at RewardsAffiliates, she confirmed that eCheck is their second most popular deposit option after Interac. That was very interesting to us. We started by featuring special links to their brands on eCheckCasinos.ca—special in that eCheck was already unlocked, similar to Spin Galaxy back in the day. However, the same story happened, and we suffered chargeback after chargeback. After some consideration, we decided to stop offering the special unlocked links on our site. We then worked with the RewardsAffiliate management team to create our own eCheck access condition. The implementation was twofold:

- Casino Rewards would show a notice in the account stating that eCheck will be available on the next deposit.

- If a Casino Rewards player makes the minimum deposit, they will see the eCheck feature appear in the cashier.

We had no choice but to implement this condition, although it greatly hurt our conversions. It seems out of 100 sign-ups, only about 7 will deposit and go through the unlock process. That shows us that most people searching for “eCheck + iGaming” terms on Google have the intent to commit fraud, which doesn’t make it an attractive term to target for casino affiliates.

Still, our site is here to cater to real players and high rollers, so we write as if they are our main audience. We don’t condone or promote fraud, and we make no money from it when it happens—in fact, it results in major losses for us. So our focus is to select the real players who might be interested in our cutting-edge fintech content.

The Happy In-Between: Third-Party eCheck Services

Some providers like PayDirect offer secure eCheck services. While they mostly cater to Interac users, some iGaming operators like Casino Rewards have started offering “instant bank transfers” by Pay-Direct.ca for all users. This is very convenient for everyone involved. Why? Because it vets players—users need to go through KYC with the payment processor first, which results in fewer chargebacks for operators (and affiliates). The only drawback is from a usability standpoint, as users now have to jump through an extra hoop. But as we said at the beginning of this article, nothing is free in life, so this is a small price to pay.

Pro tip: If you’re a new player trying to use eCheck (and want to make a good first impression), we recommend starting with Casino Rewards’ Instant Bank Transfer function from PayDirect. After your deposit, the casino will know you’re a qualified customer, and they’ll offer you eCheck (provided you meet the minimum deposit). And guess what? You get to deposit with eCheck the first time, and the second time, you’ll be able to go direct. How good is that?

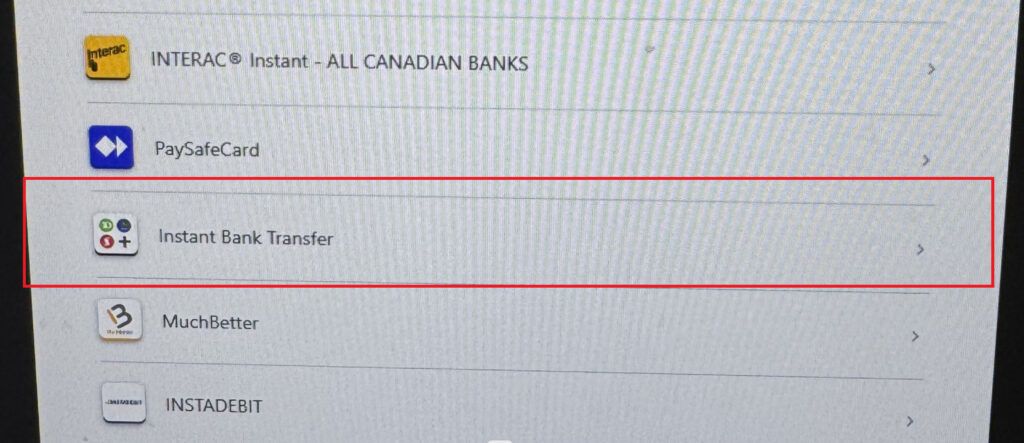

How Instant Bank Transfer Looks Like in the Cashier

Instant Bank Transfer by PayDirectNow is actually a joint project with Paramount Commerce, which is a highly reputable company and you can see they also have a chargeback mitigation strategy. As such, players going through their KYC should be highly vetted by the time they play at the casino.

Another interesting option, if you’re not partial to PayDirect, are these two choices from Payper, which we’ve covered before:

- Online Banking Payment: An enhanced electronic funds transfer (EFT) system that facilitates payments through online banking platforms. Enhanced in the sense that it has anti-fraud features built in compared to a regular EFT. iGaming clients can even set a risk threshold, which is a very nice feature to have.

- Digital Cheque (an eCheck, which is the subject of our site): An electronic version of a traditional cheque, streamlining the payment process for those accustomed to this method.

Other Third Party eCheck Alternatives Worth Mentioning.

We’ve covered them in detail on our site, but Instadebit and Idebit are also solid third party branded eCheck services. You can use them to meet the initial eCheck unlock requirements in your account.

Conclusion:

As you’ve seen in this article, if you want to be an eCheck gamer, you will need to work for it, there is no way around it. This isn’t so bad, though. KYC is expected anyways, and the only hoops you need to go through are deposit volume requirements as well as going through a small time gate. Here at eCheckCasinos.ca we think it’s quite viable to go through this process as a new player, and we can highly recommend it. It will give you an easier time to make deposits and withdrawals using fiat money. Limits are essentially waived for eCheck, and this is a really nice bonus when you’re struggling with the Gigadat or Payper Interac limits which are set to $3000 per transaction in Canada.