For most players, banking options are one of the main things they consider before signing up at a casino. In Canada, Interac has been the go-to solution for many years, with research showing that 88% of Canadians use the e-Transfer service. But even with Interac, banking delays remain a serious issue.

Depending on the casino, bank transfers can take anywhere from two to ten business days, which is pretty long especially in an industry where speed is everything. The good news, however, is that Canada is moving toward faster transactions with the development of the Real-Time Rail (RTR) system.

Payments Canada has tasked Interac Corp with building and operating this new payment network. So, what exactly is Canada’s RTR system, and what is its current status? Also, how will it impact online gaming transactions? Keep scrolling to get our in-depth overview of this revolutionary fintech technology.

Real-Time Rail: Faster Payments, Better Banking

Real-Time Rail payments are transactions that are cleared and settled instantly. In Canada, this system will enable Payments Canada members to send and receive real-time payments. It will take advantage of Interac’s existing online banking infrastructure to support transactions across 300+ banks and credit unions.

The journey toward building Canada’s first RTR system began in March 2021. Payments Canada announced that Interac Corp. had won a competitive selection process to develop and manage the RTR system. While making this announcement, Tracey Black, former President and CEO of the organization, said:

“The Real-Time Rail will be the foundation for faster, data-rich payments and act as a platform for innovation. Participants in the payment system will be able to connect and develop new and exciting ways for Canadians to pay for goods and services, transfer money and better compete nationally and internationally.” -Tracey Black

Delayed Launch and Revised Timelines

Payments Canada and its RTR delivery partners, including Interac, IBM, and CGI, have made significant progress towards launching the Real-Time Rail system. Plans to create Canada’s RTR infrastructure were initially proposed in early 2019. However, the organization revised this timeline to mid-2023 to allow additional testing and financing. In October 2022, Payments Canada changed the delivery roadmap to April 2024. This, it said, was necessary to allow more time to test and validate the system.

It’s worth noting that Payments Canada initially selected Mastercard’s Vocalink in 2020 to provide clearing and settlement services for the RTR, leveraging its experience with systems like the UK’s Faster Payments. However, after repeated delays and a strategic review, Payments Canada replaced Vocalink with IBM Canada and CGI in 2024 to complete the RTR’s technical build.

But despite these advancements, this project has faced multiple delays. Technical complexities and ecosystem challenges among stakeholders have forced Payments Canada to postpone the launch of this project several times.

As it stands, the official launch date remains uncertain. According to Payments Canada, testing will happen in 2025 and 2026 to ensure the new system meets Canadians’ transaction needs and wants. The organization maintains that the new RTR system, which could handle 25+ million transactions, must meet stringent security and reliability standards. Hopefully, this time, the rollout will proceed without further delays.

Distinction from the Interac e-Transfer Service

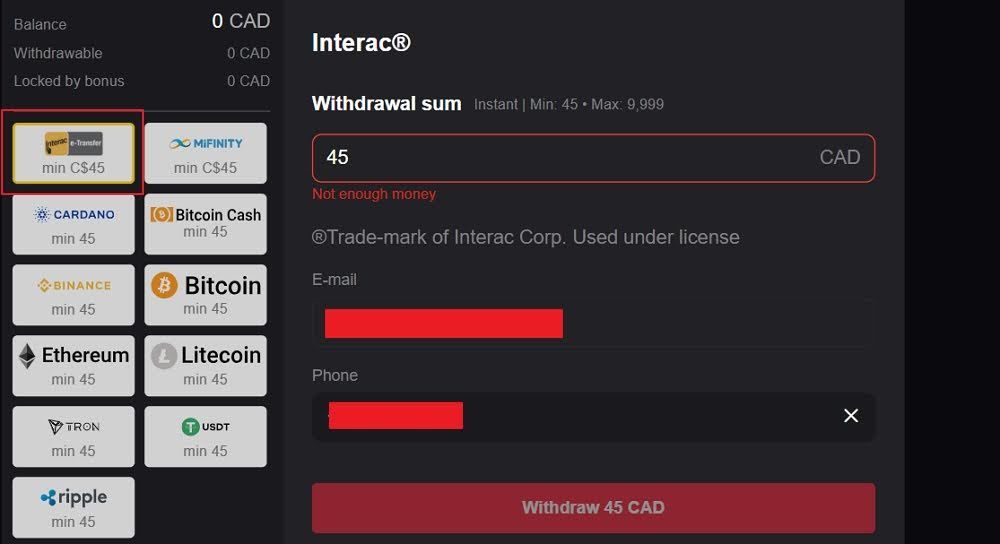

Interac e-Transfer has become one of the most widely used online banking services in Canada. It offers players a convenient way to send and receive money with only an email or SMS verification. This means e-transfer payments are often fast and pocket-friendly. You can use this service to request casino withdrawals, with payouts taking less than 24 hours.

Keep in mind that different entities can process Interac e-Transfer payments. For example, Interac partners with Loonio.ca to allow players to complete instant casino deposits and withdrawals. Other reliable Interac e-Transfer payment facilitators in Canada include Payper.ca and Gigadat Solutions.

At first glance, these partnerships may seem similar to the upcoming RTR system. After all, members of Payments Canada will leverage Interac’s expansive banking network just as they currently do with the e-Transfer. However, try not to confuse these two Interac-run services. Here are key points that should help you understand the main differences between Interac RTR and e-Transfer:

1. Settlement Finality

Currently, e-Transfer relies on the Automated Clearing Settlement System (ACSS), which enables near-instant transactions but still requires later clearance by financial institutions. Transactions are processed in deferred batches, typically settling by the next business day.

RTR, on the other hand, will eliminate this delay by allowing real-time settlements using the Lynx system. It will allow faster data transactions, reduce verification times and speed up payments. In return, this will improve security and transparency.

2. Data Capacity

Both payment services comply (or will comply) with the ISO 20022 global standards. However RTR’s infrastructure supports richer data fields, including detailed remittance information (e.g., invoice numbers, payment references, etc). e-Transfer is limited to basic sender/recipient details and security questions. RTR will also aim to minimize chargebacks, streamline reconciliation and reduce disputes.

3. Accessibility

Currently, Interac e-Transfer ranks among the most widely used online banking systems in Canada. While it’s a reliable solution, its popularity creates market complications for other Fintech firms providing similar services. Other solutions like Loonio and Gigadat have had to incorporate e-Transfer into their services to survive.

Thankfully, the Real-Time Rail system is here to level the playing field for all operators. As mentioned previously, all Payments Canada members will gain access to Interac’s infrastructure. This means even small startups can process payments from hundreds of financial institutions.

Understand: While the RTR will use Interac’s exchange component, the clearing and settlement infrastructure is being developed by IBM and CG.

However, joining the RTR system won’t be a walk in the park. New participants will need to comply with the strict Retail Payment Activities Act (RPAA) and undergo rigorous supervision. In addition, they may need to pre-fund transactions via Lynx accounts. This means they must secure a Lynx account to process real-time payments, as this move will significantly minimize potential risks.

Implications for the iGaming Industry

The introduction of the Real-Time Rail (RTR) system is set to be a game-changer for online gambling and sports betting. Players have long sought fast and cost-effective payment solutions, and RTR could be the breakthrough they’ve been waiting for.

Here are a few ways that Interac RTR could transform the iGaming sector:

- More Payment Variety: Interac e-transfer may no longer dominate as the main payment solution at Canadian online casinos. The RTR’s open infrastructure could enable alternatives like Paybilt, Loonio, PayDirectNow, and Gigadat to emerge as standalone providers—offering players more secure and diverse options. To be clear, these payment providers could now potentially use RTR without relying on Interac e-Transfer specifically.

- Fast Transactions: The main essence of online gaming is to provide instant transactions. With RTR, casino deposits and withdrawals via players’ bank accounts will now be instant. Current options like eCheck and Wire Transfer can take 3-7 business days. Even Interac e-Transfer withdrawals are not entirely instant.

- Reduced Chargeback & Fraud: Interac’s RTR will make transactions instant and irrevocable to reduce fraud cases. Today, some rogue players can dispute transactions via slow payment methods like bank cards, checks, and bank transfers.

- iGaming Compliance: Canada has one of the most liberal iGaming spaces worldwide. With Ontario’s regulated market already operational and provinces like Alberta exploring legalization, RTR’s adherence to federal financial regulations would simplify compliance for operators.

- Low Transaction Fees: It’s unclear if Payments Canada will allow RTR participants to set their own transaction fees. This is the same approach used by FedNow and RTP for the US RTR pricing. Be as it may, RTR will streamline payment processing with the benefits passed over to customers. The increased competition will also be good.

Current Reliance on Near-Real-Time Systems

Canada has always been quick to embrace new tech trends, especially in the financial sector. However, it’s interesting that the country has lagged behind in terms of real-time payment infrastructure. US citizens are already reaping the full benefits of this technology, with two RTR systems operational in the country. More than 50 countries also have RTR infrastructures.

Gaming operators rely mostly on Interac Online and Interac e-Transfer to provide instant localized payments. E-Transfer, in particular, is the most reliable solution for Canuck players seeking to withdraw money. Typically, withdrawals can take 30 minutes or several hours, depending on the online casino. Sadly, there can be a backlog of requests and cash flow friction, depending on use volume. We can see this with the numerous complaints logged against Gigadat’s delayed payments on Reddit and Trustpilot.

However, RTR will provide instant transactions, enhancing player experiences and increasing operator revenues. In a recent interview, Payments Canada confirmed that the infrastructure won’t use the e-Transfer system. The organization noted that RTR will have several differences over e-Transfer, including instant clearance, ISO 20022 support, and zero transaction holds.

All in all, the RTR could be the game-changer the iGaming industry has been waiting for. With instant settlements and irreversible transactions, players can enjoy effective gaming without annoying delays. Transaction latency when playing live dealer games or betting on in-play sports will now be a thing of the past.

The table below shows how different payment methods compare in transaction times:

| Payment method | Payment type | Withdrawal time (average) | Fees |

| Interac | Online banking | Up to 24 hours | None |

| Instadebit | Online banking | Up to 24 hours | None |

| Visa/Mastercard | Credit/debit cards | 3-5 business days | Depends on issuer |

| Bank Transfer | Wire transfer | 3-10 business days | Depends on bank |

| eCheck | Electronic check | 3-7 business days | Depends on bank |

| E-wallets | Web wallets | Up to 24 hours | None |

| Cryptocurrencies | Digital coins | Up to 24 hours | None |

Data sourced from player reports, user testing + cashier information screens

Risks of Premature Adoption Claims

Though Interac RTR’s potential looks exciting on paper, it’s important to keep expectations in check. At the moment, no commercial transactions have been processed, meaning its real-world impact remains untested. Jude Pinto, Chief Delivery Officer of Payments Canada, confirmed that the final system component was completed in 2024, but rigorous end-to-end testing will extend through 2025 and 2026.

Interac’s RTR will have to undergo rigorous scrutiny by the Bank of Canada to ensure maximum compliance. Also, the government hasn’t amended the Canadian Payments Act to provide a clear legal RTR framework, and new legislation may be necessary to expand the Payments Canada eligibility membership. In short, there is lots of regulatory work to do.

Ecosystem readiness is another hurdle to clear before the launch of Interac RTR. Most financial institutions and PSPs (payment service providers) are still upgrading their systems to conform with RTR’s ISO 20022 standard. This could take years to achieve. Remember, Payments Canada has not even announced a launch date for the Interac Real-Time Rail. So, let’s hold our horses for now.

Interim Solutions and the Path Forward

As the industry awaits the launch of Interac RTR, businesses must work with the payment solutions currently available. Presently, it’s still unclear when the RTR project will start processing commercial payments. Testing will be completed in 2026, after which Payments Canada and its partners will decide the next move. Of course, the worst scenario will be to postpone its launch for several more years.

In the meantime, the iGaming sector can continue relying on existing infrastructure, which has already proven to be efficient and effective. So, what options are available? Here are the main ones:

- Interac e-Transfer

Launched in 2021, Interac e-Transfer for Business is a reliable solution that casino operators can rely on for now. It allows players to send up to $25,000 per transaction, making it ideal for casual and high-roller players. However, withdrawals via e-Transfer can take up to 24 hours due to slow verification checks. That’s still faster than most standard payment solutions.

- Prepaid Solutions

Prepaid cards are another player-favourite solution. Paysafecard, for example, allows deposits using a 16-digit PIN, though it does not support withdrawals. However, casino operators can optimize their payment systems to provide branded cards for deposits and withdrawals. This in-house approach minimizes any transaction delays. The Play+ Prepaid Card is already a hit among operators in the US.

- 3. Blockchain Pilots

Cryptocurrencies are taking over the iGaming sector these days. Options like Bitcoin and Ethereum have become extremely popular among Canadian players looking for fast and secure transactions. Besides providing exchange wallets, some operators are experimenting with Blockchain-based stablecoins to provide sub-second settlements and maintain currency value. The only drawback of this feature is the lack of a clear regulatory path for blockchain technology.

Strategic Preparation for RTR Integration

The introduction of Real-Time Rail (RTR) is set to revolutionize the payment industry. Otherwise we wouldn’t write this entire feature on our website eCheckCasinos.ca.

Though the exact launch timeline remains uncertain, businesses that prepare in advance will have a competitive edge. Here are key strategies to help companies integrate RTR into their operations:

- Adopt ISO 20022

The Real-Time Rail network will leverage the ISO 20022 messaging standard. This means any business looking to use this service must upgrade to this data standard to ensure infrastructure and legal compliance. This typically involves upgrading internal systems to handle this technology’s rich data structure.

- Engage Sandbox Testing

Payments Canada’s Jude Pinto revealed in a press update last year that the organization will provide “industry testing” for the Interac RTR system in 2026. A forward-thinking business can maximize this chance to determine if the Real-Time Rail product meets all the requirements.

- Advocate for Open Access

Only members of Payments Canada will have direct access to Interac RTR. Of course, becoming a member is not a cakewalk. Therefore, a business can join Fintechs Canada, a national organization that brings together all Fintech companies to speak with one voice. This body is on record calling for the government to expand Payments Canada membership.

- Sign Strategic Partnerships

PSPs and Fintech companies can indirectly access the live Real-Time Rail components via Payments Canada members. This membership is only for traditional financial institutions. Therefore, Fintech companies and PSPs will partner with banks to build their subsystems. Remember that most third-party solutions have nicer frontends and better workflows than traditional clearing providers.

Conclusion

It’s clear that the financial sector in Canada is on the cusp of a big change. The Interac Real-Time Rail system will allow casinos and other businesses to access fast, efficient, and low-cost payment methods. More data means instant online transactions, which could significantly save small businesses time and money. Customer satisfaction will also hit the roof.

However, the development of Canada’s Real-Time Rail continues to face technical and regulatory challenges. Still, Payments Canada and its partners must work within the revised 2026 timeline to provide smooth testing and rollout and prevent public backlash. Other stakeholders must also prepare strategically for the system’s launch.

Meanwhile, until the RTR becomes a reality, the assumption that it’s a “game changer” is premature. Futuristic businesses must focus on implementing and improving existing solutions like Interac e-Transfer and Blockchain-based stablecoins. The pressure is on Payments Canada, Interac, IBM, and CGI to deliver a banking system that meets Canadians’ financial needs.