According to iGaming Ontario’s latest quarterly market report, the Ontario online gambling market has seen a significant rise in activity, with a total of $18.7 billion wagered in Q2 of the 2024/25 financial year. This study highlights the rising demand for reliable payment options to match the growing player activity.

Presently, eCheck and Interac stand out as the most popular banking methods in Canada. Both solutions offer smooth transactions, with eCheck allowing for electronic check transfers (EFTs) and Interac enabling online banking payments. But which one is the better choice for your casino payments? This guide dives into both options to help you decide.

First, What is Interac?

Launched in 1984, Interac is a payment network that facilitates transactions between financial institutions in Canada. This interbank network ranks among the most popular online banking methods for Canadians. A report published in September 2024 revealed that every three out of five Canadians have used Interac to send or receive money.

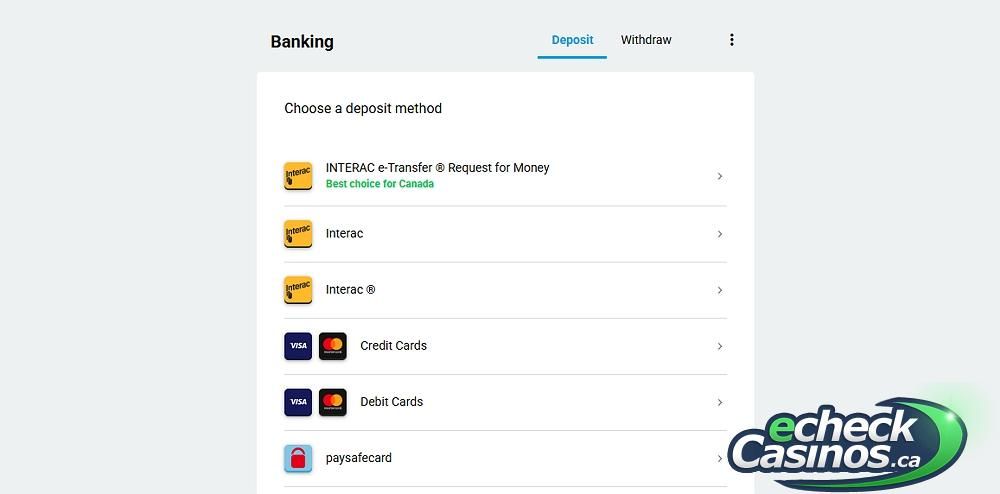

Interac has two main products for online gaming: Interac Online and Interac e-Transfer. With the former, all you need to do is open the casino cashier and select Interac. The gaming site will redirect you to a gateway to choose a bank and deposit using your online banking account.

Interac e-Transfer, on the other hand, lets you send or receive money electronically. This is the most common Interac modality for iGaming. To initiate the transaction, you’ll need to provide your email or phone number. Interac will then send a text or email to confirm the transfer. It’s that easy.

It’s also worth mentioning that some third parties also leverage Interac’s expansive banking infrastructure to process payments. A popular example is Gigadat, often referred to as “Interac Powered by Gigadat” at many casinos. This service helps facilitate secure casino payments using both Interac Online and Interac e-Transfer.

Other alternatives include:

- Loonio: A Canadian platform that utilizes Interac’s infrastructure to process payments directly from bank accounts.

- Payper: This payment service allows you to send and receive payments via Interac e-Transfer, Interac Online, and Online Banking Payment.

- PayDirectNow: This solution lets you deposit and withdraw money quickly using Interac services or Instant Bank Transfer.

Interac is the desired choice at most Canadian online casinos. It is the number one deposit method at Casino Rewards brands like Luxury Casino, according to the affiliate manager. eCheck is only second in terms of popularity at CasinoRewards. Interac comes with benefits like integration with all major banks, instant deposits, and reliable withdrawals. Integrity and reliability are also among its main selling points.

What is eCheck?

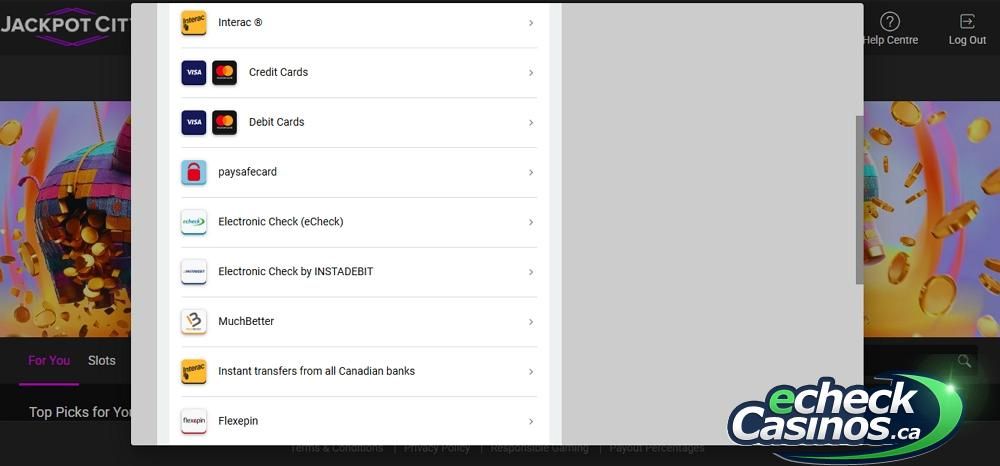

The term “eCheck” is a short form for electronic checks. Payments here work just like traditional checks written using a pen or paper. With eCheck, funds are transferred electronically from your bank to the gaming site through the ACH (Automated Clearing House) network. Some casinos also process direct eCheck payments.

If you want to deposit via eCheck, simply choose this method and fill out the requested details. The eCheck casino will ask for information like your bank name, account type, bank account number, and social insurance number. Make sure to choose a regulated and reliable casino you can trust with your banking details.

The main benefit of using eChecks for casino transactions is security. Payments are processed in a bank-grade environment, reducing any potential security risks. On top of that, it’s among the most secure methods to process significant casino deposits. This makes it ideal for high rollers.

Presently, Canada has a variety of eCheck service providers. However, due to the unregulated nature of the national online gambling landscape, some providers are reluctant to process casino payments. Despite this, there are still several options available. They include:

- iDebit: A widespread online casino payment method that acts as a ‘middleman’ between your bank and casino accounts. Like Interac, iDebit is a local payment solution that supports most banks and credit unions in the country.

- Instadebit: An online bank transfer payment method that allows you to deposit and withdraw money at most casinos. Instadebit supports transfers between all banks and financial instructions in Canada.

- PayPal: This option is largely known as an e-wallet rather than an eCheck service provider. However, PayPal lets its Canadian customers link their bank accounts to process eCheck payments. The clearing duration is 4-7 days.

Sometimes you may need to make non-gambling eCheck transfers. If that’s the case, you’re in luck because there are many non-gambling eCheck payment service providers. Below are some reliable options to consider:

- Chase Paymentech: Operated by Chase Bank, this service processes electronic checks within 3-5 business days.

- Paycron: This service offers secure 24/7 eCheck processing for high-risk merchants at low fees.

- EBizCharge: This payment gateway allows businesses to accept credit/debit card and eCheck payments.

- Authorize.net: It allows businesses to process eCheck payments directly from the customer’s bank account.

- Moneris: This local payment service provides all banking solutions, including eCheck ACH processing.

- Elavon: Uses the Electronic Check Service (ECS) feature to convert paper checks into electronic payments.

- Square: It provides a POS (point of sale) system for sending and receiving eCheck payments in Canada.

- Stripe: This service supports ACH Direct Debit payments for processing electronic check transactions.

Comparison: Speed and Convenience

When comparing these two in terms of speed and convenience, there’s a clear winner: Interac. For many years, Interac has presented itself as the ideal solution for processing fast online banking payments. You don’t need to provide bank account details to use this solution. Interac supports casino deposits and withdrawals, with payouts taking around 24 hours.

Although eCheck uses Automated Clearing House to speed up payments, bank processes can delay these payments. In most cases, casino payments via checks can take 3-7 business days. Most players don’t want to wait a week to fund their casino accounts.

Comparison: Security and Trustworthiness

This comparison is a close one, as both options are secure and reliable. eCheck payment providers like Paycron and PayPal use multi-layered authentication systems to protect payments, including biometric identification and 2FA. On the other hand, Interac processes payments more securely with an EMV chip, which ensures enhanced data protection.

Regarding trustworthiness, it’s safe to say that most businesses use eCheck payments. According to a recent revelation by Statistics Canada, seven out of 10 businesses process check payments. Interac is used by 50% of businesses nationwide. However, we’d like to assume that most players would prefer Interac for convenience.

Comparison: Fees and Costs

Interac charges a small fee, depending on the service. For example, Interac payments made via Google Pay or Apple Pay incur a flat fee of $1.80 for transactions over $300. Some financial institutions can charge a small fee to process e-Transfer payments. To avoid these charges, consider using third-party services like Loonio and Gigadat.

Now, this is where eCheck stands out completely. Electronic checks generally have lower processing costs than Interac or in some cases, no fees at all. However, this depends on the bank or casino payment policies. So it’s important to read the payment terms before using this option. Note that you can incur chargeback fees if your electronic check deposit bounces.

Comparison: Accessibility and Availability

Interac is one of the most widely accepted payment methods and is available at nearly all online casinos. One of the reasons behind this popularity is its vast banking network. You can process Interac payments to and from 200+ banks and credit unions in Canada.

eCheck, meanwhile, has limited availability in the online gaming sector compared to Interac. Most casinos, primarily offshore gaming sites, don’t process direct eCheck deposits due to banking policies. However, you can still find several eCheck casinos in Canada operated by brands such as Bayton, Cadtree, and Baytree Limited. Jackpot City and Spin Casino are great examples.

Comparison: Suitability for Different Player Types

We all have different playing styles and preferences. And yes, your style of play could influence the banking method you choose, especially when the choice is between Interac and eCheck. For instance, Interac is ideal for casual players who prefer fast and convenient payments. Some casinos like Captain cooks process as little as $5 deposits using Interac.

If you’re a high-spender with a big budget to deposit, eCheck may be the best solution. Most casinos that accept eCheck payments allow gamers to deposit huge sums. Of course, this could lead to more loyalty points and better VIP treatments. Some gaming sites also prefer sending you a check if you win a significant amount or a jackpot. Just beware of the slow transaction times.

Pros and Cons Summary Table

Knowing the pros and cons of these payment solutions can help you make a more informed decision. The table below offers a clear summary to guide your choice.

| Feature | Interac | eCheck |

| Speed | Deposits are instant, with payouts taking 24 hours. | Clearing eCheck payments could take 3-7 days. |

| Accessibility | Accepted by most casinos and supports 200+ financial institutions. | Has limited availability in iGaming despite supporting all major banks. |

| Fees | Low transaction fees, with some casinos processing fee-free payments. | Casinos process eCheck payments for free, although bank charges may apply. |

| Security | Uses SMS and email verifications to ensure maximum safety. | The casino will not see your banking information. |

Will Interac Become the Default Payment Solution in the Future?

The Canadian banking landscape is quickly advancing from cash transactions and direct bank transfers. Most Canadians prefer the convenience of using electronic payment solutions like Interac as it offers swift transactions and widespread accessibility. However, it’s still a bit too early to declare Interac “the future” default banking method in Canada. Innovations like the Real-Time Rails (RTR) and e-wallets have emerged to provide even more convenient online payments.

We must also not overlook the impact of cryptocurrencies in the modern digital economy. According to Statista, the penetration rate for these digital coins could hit 33.89% in 2025. Today, most casinos process crypto payments for deposits and withdrawals. There are no bank processes or wait times here, meaning payments are faster, cheaper, and available 24/7. As such, Interac should prepare for intense competition from e-wallets and cryptos.

Below is why cryptos and e-wallets are attractive options:

- It’s easy to set up an account without providing bank details.

- Payments are processed 24/7, including on business days.

- Some casinos process instant payments via these options.

- Lower or zero fees compared to Interac and eCheck payments.

Interac’s Edge with Real-Time Rails (RTR)

Anyone looking to challenge Interac’s dominance in Canada will face a tough competition. Interac is always coming up with new innovations to streamline payments countrywide. This makes Interac an appealing choice for younger, tech-savvy gamers who prioritize convenience and speed.

In March 2021, Payments Canada announced that Interac will build and operate Canada’s first-ever real-time rail (RTR) system. As the name suggests, this solution allows members of Payments Canada to send and receive payments in real time 24/7/365. That’s a clear win for Interac.

The real-time transfer of money using the RTR system will give users more control over their finances. Bank transfer payments will now be in seconds instead of days. The issue of processing payments on business days only will also become a thing of the past. This Interac-run infrastructure will provide a platform for new and innovative payment products to thrive.

Challenges for eCheck in the Modern Era

We can now agree that the era of carrying around a chequebook is over. Today, most businesses, including online casinos, accept electronic checks, which are similar to regular checks. However, we must admit that electronic checks have not achieved their full potential in the current payment landscape. So, what’s preventing eCheck from being the mainstream payment method?

First, the 3-7 days of payment processing is too slow for modern gamers looking for faster transactions. When choosing a casino in CA, one of the main things players consider is transaction times. Electronic checks fail to tick this box because deposits and withdrawals must undergo traditional bank verification processes. Remember, the 3-7 days exclude holidays and weekends.

Another significant challenge is acceptability and accessibility. You may have to do some digging to find a casino that directly processes eCheck payments. Meanwhile, as electronic checks continue to struggle, Interac and other modern banking methods are having a field day.

But despite its fading appeal, eCheck continues to appeal to high-rollers with big money to transact. Now consider this: most casinos rarely exceed the $5,000 mark for Interac deposits. This limit could inconvenience high-rollers with significant budgets. Electronic checks are a reliable and convenient option for such players.

The Rise of Competing Payment Methods

Both Interac and eCheck are not safe from competition. Many players choose cryptocurrencies like Bitcoin, Ethereum, and Dogecoin. These coins use a decentralized blockchain ledger, eliminating the need for bank approvals. This makes payments via digital coins faster and more cost-effective. Most reliable casinos take an hour or two to process crypto withdrawals.

Electronic wallets are excellent alternatives for those who are still skeptical about the new blockchain technology. These wallets are popular, especially among Gen-Z and Millennials, who have probably never seen a physical check. Research conducted in July 2024 by Retail Insider reveals that 63% of Gen-Z Canadians use digital wallets. That’s a huge number to ignore.

Interac’s increasing dominance in the Canadian financial sector could further complicate matters for eCheck. The launch of the RTR network will likely make Interac the default Canadian payment solution in the iGaming industry. As we mentioned earlier, this integration ensures that Interac payments are now faster and more accessible.

Still, we cannot ignore the value of eCheck payments in online gaming. This payment solution could retain a small section of gamers looking for higher transaction limits. But all said and done, the future of eCheck transactions in online gaming looks uncertain. We expect Interac and other modern products to continue dominating this sector.

Personal Opinion : eCheck is great for Micro-Deposits

Because fees are waived for deposits, I find eCheck to be well-suited for my playstyle which involves micro-transactions. Some players feel this is safer—it’s like you deposit only as needed and avoid the risk of losing a lump sum upfront. With Interac, the fee structure would be prohibitive anyways, especially when making so many small deposits. Lastly, for small sums, casinos often credit you the funds before they clear, so the major drawback of delayed processing with eCheck is gone.

Conclusion

High rollers looking to maximize casino loyalty schemes may find it wise to pick eCheck over Interac. Most casinos allow you to transact large amounts securely with eCheck. However, keep in mind that this method comes with longer processing times, so it’s best suited for players who value transaction limits over speed.

In closing, the choice between eCheck and Interac depends on your playing style and personal preferences—eCheck is ideal for high rollers, while Interac has the upper hand for casual players.