1. Introduction

eChecks are a popular way to process player deposits and cashouts on Canadian iGaming sites. However, as every deposit method comes with pros and cons, so do eChecks. The limitations here are by virtue of being tethered to the Canadian banking system, much like ACH in the US. This mostly means timing matters, and not all days are created equal. Experienced players will know that banks and clearinghouses don’t process uniformly across all days. In this guide, we will set expectations for first-time eCheck users. We will show, in particular, how weekdays, weekends, and holidays impact deposits and withdrawals.

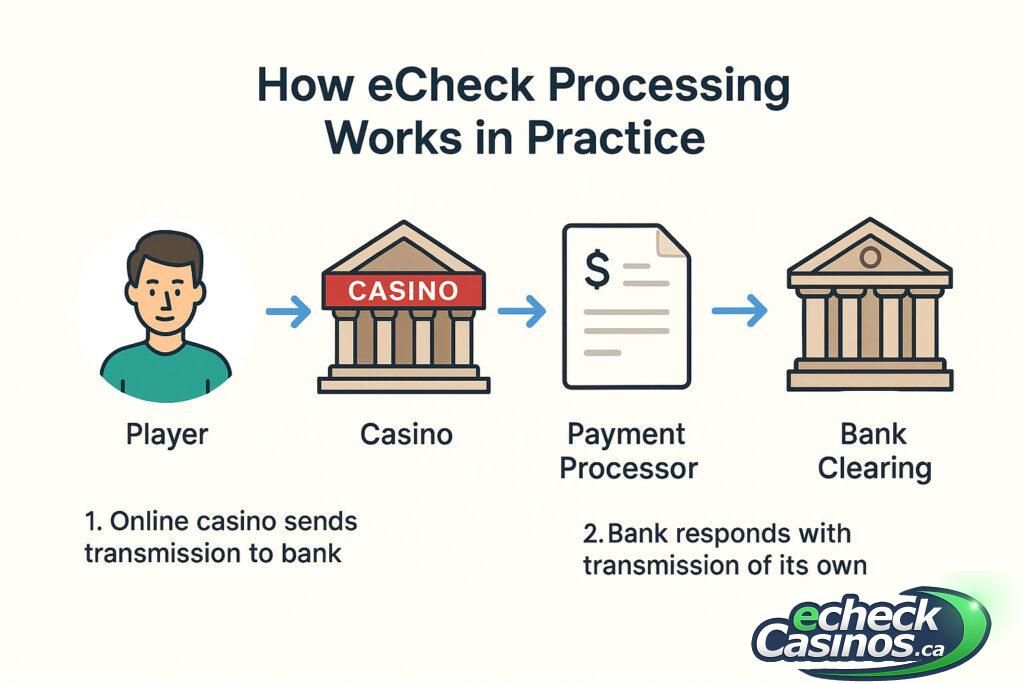

2. How eCheck Processing Works in Practice

- Step-by-step breakdown.

One of the common bottlenecks of eCheck cashouts is batch processing. This means players typically need to follow ACH-style timelines. View this as a simple lag, or time delay. In practice, just know there is a big difference between settlement acceptance vs confirmation. This is not the crypto space where payments take place in near real time. They basically need to clear first.

Sources:

- https://paymentcloudinc.com/blog/echeck-processing-time/

- https://zenpayments.com/blog/echeck-processing-how-it-works/

- https://www.pdcflow.com/resources/guides/guide-to-processing-ach-transactions/

3. Understanding the Weekly Rhythm of eCheck Processing

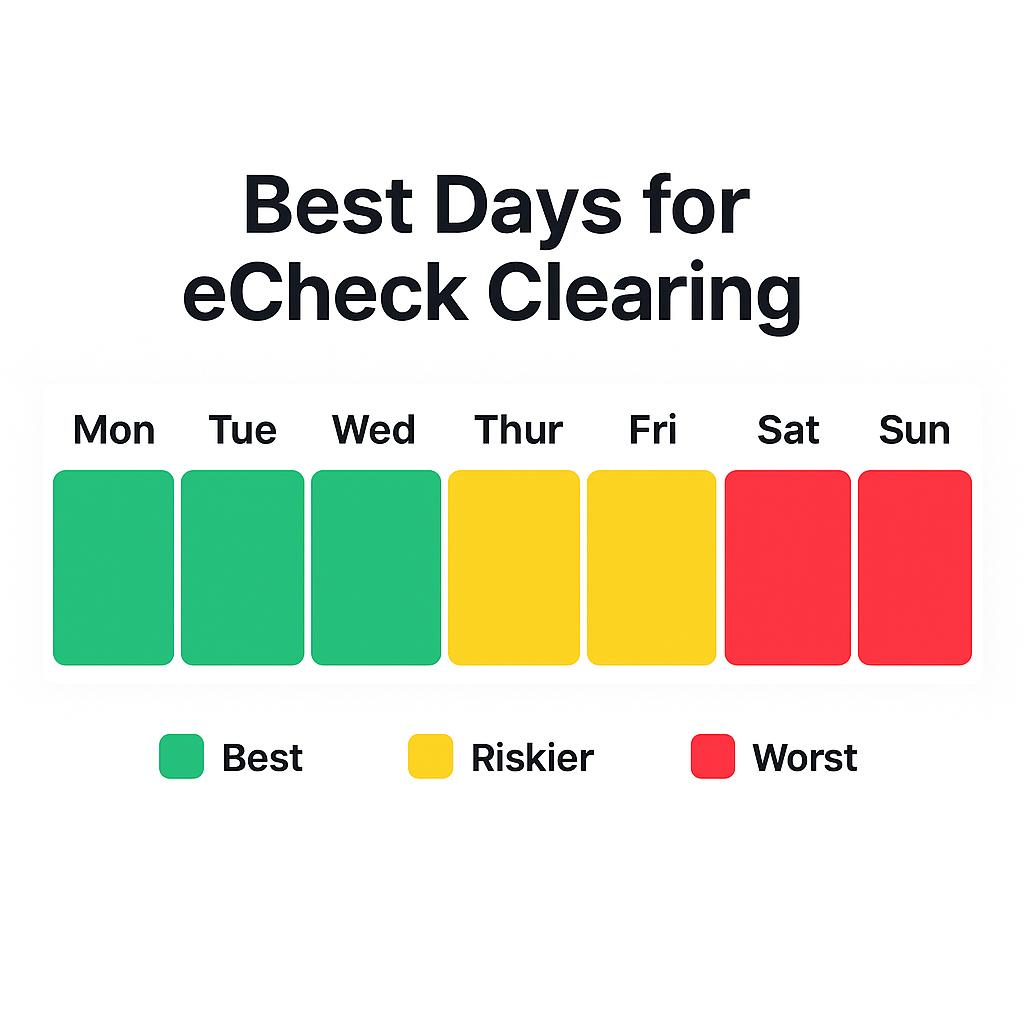

As we said in the introduction, not every day is created equal in terms of eCheck processing. If you’re planning a cashout, the following information may be critical to you:

- Monday–Friday: standard bank clearing windows. We recommend to initiate payments towards the beginning of the week (see our rating of days below)

- Weekends: banks closed; deposits may post instantly at casino but withdrawals queued until Monday.

- Fridays: risk of “extra-long” pending period if request submitted late.

- Holidays: Canadian banking holidays add 1–2 day delays. Here is a link to Canadian banking holidays.

4. Player Impact: Deposits vs Withdrawals

For players, the impact is almost always on cashouts. Why? Because casinos trust that when a player initiates a deposit, the funds will arrive as promised. They basically give the benefit of the doubt to all players universally, which is a good thing. However, if you don’t have enough funds in your account, your deposit may “soft fail” after 1–2 business days. Even if you deposited in good faith, but your bank charges it back, that could be the end of your relationship with that casino. Why? Because unfortunately you may get lumped in with a subset of players who exploit this to take advantage of operators. You can, of course, make your case and get your account unlocked, but two strikes would likely be the maximum you could endure.

For withdrawals, the processing bottleneck is usually the bank’s clearing schedule, not the casino.

- Example scenarios of delayed cashouts:

- Depositing Friday night vs Monday morning.

- Withdrawing on long weekends.

- Depositing Friday night vs Monday morning.

Again, that’s why we recommend you stick to our chart showing best days, with the color codes above.

5. Casino-Side Variations

Now, even though most of the bottleneck is banking-system related, there are some minor casino-side variations. Don’t get your hopes up, however—you won’t find a magical brand that offers same-day eCheck processing. Here are the factors where brands may perform slightly differently. First, you need to understand:

What casinos can (and can’t) control

Casinos can control when they release/submit your withdrawal file to their processor (e.g., same-day submission before a bank/processor cut-off can hit that day’s batch).

Casinos can’t speed up bank clearing itself, which follows ACH/EFT batch windows and business-day schedules. See Donna’s article for more information here. Weekends/holidays push processing to the next business day

Withdrawal Processing Time (Pre-Bank)

Some casinos release withdrawals to the processor the same day if you request early.

Others have a 24–48 hour pending period (often for fraud/KYC checks) before sending to the bank.

That lag is on the casino side, not the bank. Usually the Casino Rewards brands outshine Baytree here, only slightly.

Cut-Off Times for Submission

Payment processors/banks have batch cut-offs (e.g., 11 AM or 4 PM EST).

If a casino submits your withdrawal before cut-off, it enters that day’s batch.

If after, it waits until the next business day. Different casinos may set their own internal cut-offs.

KYC & compliance reviews

Even with the same payment rail (eCheck), big casino groups can differ in how quickly they complete verification, fraud screening, and AML checks. A “compliance-heavy” operator might add an extra day, while select ones release faster.

Internal Payment Policies

Of laste note that certain casinos have a “pending reversal” window (giving players time to cancel a withdrawal and keep playing).

Others process instantly, with no reversal option — much like crypto, which is irreversible.This policy choice changes when your withdrawal actually leaves the casino.

Bottom line on player experience impact

This explains why two players, at two different casinos, can have completely different perceptions of eCheck speed — even though the actual bank clearing time (3–5 business days) is fixed. The difference lies in casino-side release policies, not the rail itself.

6. Player Tips for Faster eCheck Cashouts

Here is an eCheck cheat sheet to keep lady luck in your pocket — not just for the games, but for cashouts, which are arguably the most important part for any player.

- Time withdrawals earlier in the week.

- Avoid requesting on Fridays/holidays.

- Keep account verified to skip manual review.

- Consider backup payment methods for urgent cashouts (for example Loonio or crypto)

7. Safety and Trust Considerations

In any case when choosing eCheck as a deposit modality, you can rest assured that it’s safe and bank verified. Delays do not point to maliciousness, but again, just to the normal functioning of the Canadian banking system. So you can relax in that department—it’s not like sending crypto to an obscure recipient or an Interac based product like PayDirect to a strange email. But always do your due diligence first.

Also, the safety of this method may add some lag by its very nature. That’s because it involves embedded banking and responsible gambling safeguards (transaction monitoring, limits, AML checks), which can add time—but also protect players.

Again, we want to emphasize trustworthiness here. Don’t assume the casino is “holding funds somehow.” Processing delays are systemic, not the casino stalling or preventing cashouts, which would be illegal under their licenses. For example, if you use eCheck for online shopping with PayPal, the same applies. Of course, if you think the casino operator you’re playing at is not legitimate, then please switch operators. On this site, we only recommend licensed brands.

8. Conclusion

We hope this article shed some light on your prospective eCheck deposit. As you can see, it’s really about timing, and the calendar matters for withdrawals. There is also some leeway with different casino brands, and you might prefer one of the Casino Rewards brands, which have plenty of experience processing eCheck requests at scale. In any case, we encourage smart planning for both deposits and cashouts.

More information of interest: