Welcome to another eCheckCasinos.ca guide ! This time we’re diving into the dangers of eCheck as a deposit method. We don’t mean to scare you away, but yes, everything in life comes with pros and cons. And payment options are no exception. Personally, I remember losing a $500 echeck deposit pre-UIGEA in the United States at an unlicensed site (one of my low points). It made me rethink my hobby as an iGamer, but I’m glad I stuck around. Thankfully, Canada doesn’t have laws that restrict iGaming payments at the source – like UIGEA- but there are still some risks involved. That is, even if you choose (as you should) licensed operators. If you play at unlicensed sites, or bitcoin/crypto brands, that is outside the scope of this article.

Let’s start with some numbers. According to Statistics Canada, 94% of Canadians now rely on the internet for their day-to-day activities. That should be a given – I know I struggle without a live internet connection even for a few minutes.. But what’s interesting is this study reveals that at least 8 out of 10 Canadians have used online banking services to manage their finances. This includes options like Interac, bank transfers, and, of course, the theme of our website: electronic checks or eCheck.

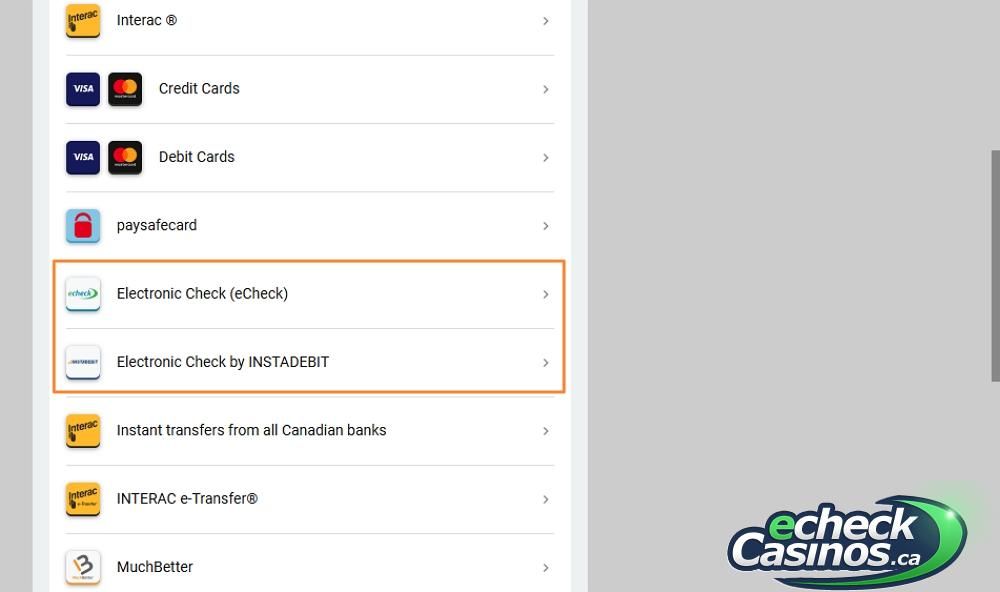

But what exactly are eChecks… Good question, if I may say so. Well, an eCheck is simply a digital version of a paper check. The answer was in the question ! Instead of manually signing a physical check, funds are transferred electronically from your bank account to a merchant. This happens via the Canadian payment clearing system. In the USA, it happens via the ACH system (Automated Clearing House). All you need to provide are your bank account details to complete the transaction, things like routing number and account number. This makes eChecks work without the need for physical paperwork. If you can never find your keys… this might be the perfect solution for you (and for me, as it happens).

In Canada especially, eChecks have become a “go-to” payment method for a variety of purposes. Think rent payments, recurring bills, and taxes —yup, that wide. They have also become part of online gaming lingo, where the term is now almost synonymous with gambling. Bookies and sports bettors frequently use the term as well. Electronic checks were initially branded by Pokerstars as “instant eChecks” for Pre-UIGEA iGaming. And they took off from there… The rest, as they say, is history. Almost 20 years later, and casinos still prefer to use eChecks to process deposits and withdrawals for their biggest players.

However, despite their growing popularity, and having stood the test of time, eChecks are not without risks. The Canadian financial sector has recently experienced a significant 202% increase in digital fraud attempts. These worrying numbers make protecting your eCheck payment details quite important in 2025. That’s why we’ve prepared this guide.

1. Security Vulnerabilities and Fraud Risks

As a rule, we always encourage our readers to remain vigilant with their financial information. No security system is immune to vulnerabilities. Now, it’s true eCheck uses advanced technology, such as encryption and fraud detection systems, to protect transactions. However, phishing and social engineering attacks are on the rise. Also, brute force attempts are common as well as hacks on vulnerable electronic payment systems.

Did you see the news recently ? Slim CD, a Canadian payment gateway provider, suffered a cyberattack that exposed sensitive credit card information of roughly 1.7 million users in Canada and the U.S. The compromised data included names, addresses, credit card numbers, and expiration dates. Here’s what our writer Trevor has to say:

No payment system is infallible… truly. The only way to protect yourself as a consumer is to limit what you share online. That’s why I personally don’t use my credit card to make deposits online; I always go through my bank account, either via eCheck or Interac. The redundancy loop, where it asks you to log into your account, closes most security risks while also ensuring you don’t divulge more than necessary. With a credit card, all they need is the number—some sites don’t even ask for the billing address. My favorite deposit method right now is Loonio, a sort of Interac on steroids that really streamlines deposits and requires minimal information. – Trevor Hallsey

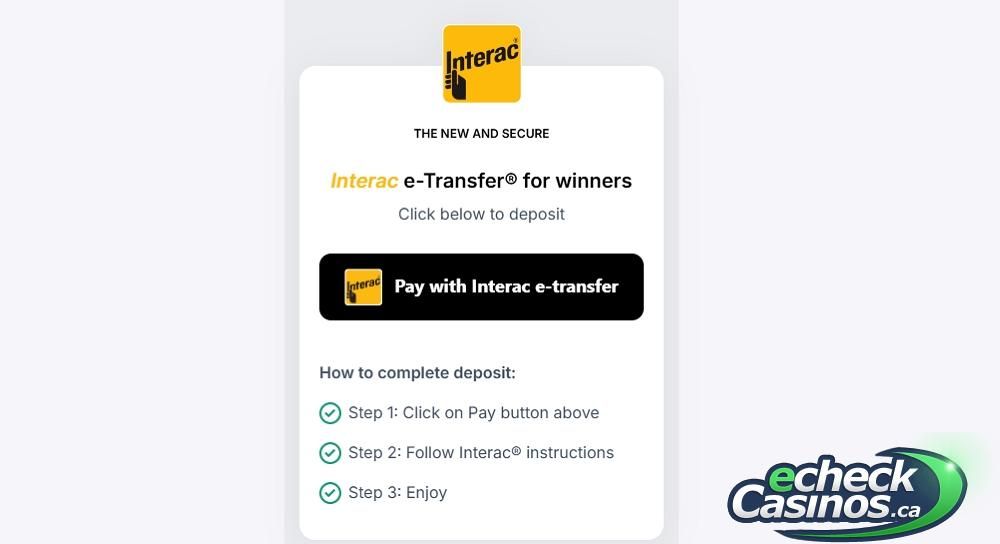

So, instead of waiting days to receive payments, you can consider using an option like Interac. This popular online banking network uses secure systems to process payment transfers instantly. You may wait up to 30 minutes at most, which is still fast enough. The most popular Interac product for iGaming is called Gigadat. If speed is really of the utmost importance to you, payments via e-wallets and cryptocurrencies are even faster. Plus, these options offer 24/7/365 transaction availability.

4. Risk of Interception and Information Theft

Cybercrime continues to be a challenge in Canada, due to most payments being processed online. The latest cybersecurity statistics show that Canadians were victims of over 41,000 cybercrimes in the first half of last year. Even more worrying is that 56% of those online crimes were associated with fraud.

Electronic check payments often involve sharing vital banking information. This makes them the ideal target for online attacks. Attackers can use social engineering techniques to trick you into providing your bank account details and use them to commit fraud. Misplaced eCheck banking information and account passwords also contribute significantly to online fraud.

On the bright side, eCheck payments come with a key security; merchants never gain complete access to your banking information. All you need to provide are your checking account details and address. The eCheck is sent directly to the bank, ensuring your sensitive information stays out of the recipient’s hands.

I think this one comes down to common sense. Would you walk closer to strangers in a dark alley? In real life, we have bodyguards, but online, we have firewalls. I highly recommend that people at least install a basic antivirus program (Kaspersky is good) along with a quality malware scanner like Malwarebytes. You never know what might “bite” you online (pun intended). Always-on firewall tools are truly lifesavers—some are so advanced that even if you click a malicious link, they can block the action and send you a warning. Personally, I’m a bit paranoid, so I always have spyware, malware, and antivirus programs running in the background. I feel like they’ve got my back, so I can focus on writing—which is all I care about. . – Dana Nikolic

To further secure your eCheck transactions, as a user, here are some tips to follow:

- Create a strong bank account password and change it regularly.

- Enable multi-factor authentication (MFA) for an extra security layer.

- Only use secure, password-protected Wi-Fi networks to initiate transactions.

- Don’t initiate eCheck transactions on unencrypted or malicious websites.

- Verify customer information before receiving eCheck payments.

- Regularly update your device and browser applications with the latest security patches.

5. Lack of International Standardization and Acceptance

One of the drawbacks of using eCheck is the lack of international acceptance. According to PayPal, eChecks are primarily designed for domestic use. This means international transfers via this payment method can be problematic. ACH and eCheck systems are usually ring-fenced to specific regions, with one side of the “fence” in the USA and the other in Canada. That’s why most offshore online casinos rarely process electronic check payments.

As we explained previously, eCheck payments in Canada rely on EFT systems, while in the US, they use ACH networks. Although both terms can be interchangeable, there are some slight differences. ACH connects bank accounts directly, while EFT is used for account-to-account payments. And they come with clear (domestic only) geo-restrictions.

There are several solutions to process international payments. An example is Western Union, a reliable money transfer service in 200+ countries. Keep in mind that transfers can attract a fee of between 1% and 6%. On the other hand, e-wallets like PayPal and Skrill offer a faster and more secure way to transfer money instantly across borders.

Just remember that Checks are typically ring-fenced for domestic use, primarily between the U.S. and Canada, making cross-border transactions with this method close to impossible.

For the younger and tech-savvy generation, cryptocurrencies like Bitcoin, Ethereum, and Dogecoin are another solid alternative. Unlike fiat currencies cryptos are decentralized public assets. Transactions are recorded on a public blockchain and this ensures transparency and security.

To get started with Web 3.0, we recommend setting up a secure crypto wallet.

6. Over Reliance on Electronic Infrastructure and Technical Failure

As mentioned earlier, eCheck payments rely on ACH/EFT, an automated electronic funds transfer system to clear and process payments. This network processes all eCheck debit and credit transactions and also manages huge volumes of transactions. An example is Nacha’s Same Day ACH, which recorded a massive 67% more transactions in Q3 of 2024.

However, as effective as they are, ACH networks sometimes fail, just like any electronic funds transfer system. And this is more likely to happen during times of peak use, much like a server that isn’t equipped to handle a sudden influx of traffic. A relevant example would be Black Friday, when retailers are bombarded with eCheck payments. At worst, the overall EFT system might go down (although this is quite rare); and at best, your eCheck will be queued as they sort through all the other e-Check orders one by one. On a smaller scale, the increased demand for electronic checks in Canada can lead to ‘errors’ like software glitches and server downtimes. It’s also clear that these systems require regular maintenance, which lead to temporary scheduled downtimes.

When ACH failures happen, businesses may experience payment delays or even losses. Therefore, having a contingency plan for any eventuality is important. A company can assess its payment systems to identify potential weaknesses and address them or source for third-party ACH services. Accepting payment alternatives like Check by Courier and Bank Wire is also a solution.

“As a hobby photographer, I always check out Black Friday deals at B&H, but I’ve learned not to rely on eChecks during busy times. With so many payments being processed, the EFT network in Canada can slow down, and I don’t want to risk my order being delayed. I stick with credit cards—it’s faster and more reliable for grabbing the gear I need. Plus, it looks like B&H no longer accepts PayPal eChecks, maybe for this very reason.” — Trevor

7. Potential Errors in Automated Systems

While ACH systems are generally reliable, errors can occur due to human mistakes. Failure to cross-check payments may sometimes lead to rejected checks and expensive business losses. Your check could fall into the wrong hands if you don’t use the correct account number. And remember, receiving a refund can be time-consuming and expensive.

An ACH system could return an ‘error’ message if there’s insufficient money in the sender’s bank account. Payments may also fail to go through due to invalid account information or using a closed/suspended account. Even minor errors such as entering the wrong entry date can give you an error message.

Below are a few codes that may indicate a technical failure:

- R02: A closed account

- R04: An invalid account number

- R20: Non-transaction account

- R24: A duplicated entry

- R28: Routing number check digit error

The good news is that human errors in ACH transactions are avoidable. You can reduce delays by making sure your eCheck account details match the bank information. In addition, make sure your bank account has enough funds to send an eCheck. The last thing you want is an expensive chargeback. And yes, contact the bank in case of any unusual payment delays. It could be something that the bank can resolve over the phone. You can find more information about Canadian banks that support eCheck here, as this will affect your depositing outcomes.

Conclusion

It’s a dangerous world for an iGamer out there. That’s why adopting simple safety measures, such as the ones mentioned in this article, can go a long way. We hope this piece has informed you and encouraged you to brave it out and achieve your iGaming goals. With due diligence and awareness, electronic checks can be a reliable and secure payment option. Good luck!

There’s more than just brute force or hack attempts too. Social engineering is when thieves deceive you into sharing your bank account details or clicking malicious links. This means attacks can be hard to stop.

Fraudsters can also access bank accounts and routing numbers through misplaced invoices and transaction receipts. Personally I receive invoices from Paypal on a regular basis that I never requested. I’m always careful to Google the email of the sender, and more often than not it’s listed in a known scam database. These invoices are getting more clever and sometimes it really seems like they were sent from Paypal, but I digress…

Indirect breaches are another major risk. Many companies share their banking details with vendors to facilitate direct and efficient payments. Not just in iGaming but in eCommerce too. If these details fall into the wrong hands, they can lead to serious consequences for users. For instance, in the 2023 NCB Management Services breach, hackers accessed sensitive financial data belonging to nearly 500,000 Bank of America customers after infiltrating a third-party debt collection vendor.

Lastly, another way that fraudsters exploit the security vulnerability of eChecks is through initiating unverified chargebacks. Although checks can take days to deposit, in practice, the money is often credited before the check clears. This means eCheck chargebacks are harder to defend against.

Here is an example of a pattern we see used in iGaming. Rogue players chargeback their deposits if they lose. They call up their bank and say someone accessed their accounts for illegal gambling. It goes without saying that lying to banks with the intent to defraud the casinos like this clearly illegal.

In comparison, obtaining refunds with options like Interac, e-wallets, and cryptocurrencies can be challenging. Only credit cards are more commonly associated with chargebacks, offering consumers a higher likelihood of recovering disputed funds. This explains why many online casinos are hesitant to support eCheck payments. There is a lot of abuse from the client end of things basically.

2. Insufficient Fund Penalties and Banking Fees

Now that we understand the security risks associated with using eChecks for online payments, let’s talk about penalties and transaction fees that can come with their use. Just like traditional paper checks, an eCheck can “bounce” if the sender’s account doesn’t have sufficient funds. In that case, the sender of the check will incur an NSF (non-sufficient funds) fee.

So, how much do banks charge for failed eCheck payments? The law requires banks to charge no more than $10 for NSF transactions. However, most banks typically charge anything between $45 and $48 in CAD. This can be a painful loss for a gambler or a business person looking to get value for every penny.

Personally, this happened to me recently. I still have a small local bank account in Berkeley, California, from my time studying there. I was overusing my PayPal eCheck account recently —not in the sense of breaking rules, but thinking I had enough funds to cover a payment when I actually didn’t. My local bank still processes these transactions with NSF (Non-Sufficient Funds), but only for checks, eChecks, and auto-billing—not for card payments.Their policy is that if the overdrawn amount at the end of the business day is $10 or more, they charge a $35 NSF fee. I tried to replenish my account in time, but I forgot that receiving an income wire has a $10 fee on the receiver’s end. Because of that, I ended up getting hit with the fee. It happens—but it’s good to understand how these things work. – Trevor Hallsey

Therefore, always confirm if your bank account has sufficient money before transacting. For an easy way to estimate your eCheck deposit fees, consider using our eCheck fees calculator.

Electronic check payments also have small transaction fees – on the bank side – if everything sails smoothly. On average, this fee can range between $0.30 and $1.50 per transaction. Now consider this: domestic bank wire deposits via CIBC bank can cost between $30 and $80. TD Bank can charge $50 for the same transaction. This means eCheck payments are more cost-effective for significant bank transfers.

3. Delay in Funds Clearance and Processing Time

Many Canadians are reluctant to use eCheck payments due to processing delays. On average, transactions can take 3 to 7 days to complete. Also, it’s important to remember that payments are only processed on banking days. This means eChecks can’t be transferred or received on weekends or holidays, which can be a problem in case of emergency.

Here’s why this happens: eCheck payments go through multiple processes and security checks before the funds are credited to your account. Below are the key steps involved:

- A customer authorizes an eCheck payment.

- The bank moves the check to an ACH or EFT (Electronic Funds Transfer) network.

- The electronic network takes 24 to 48 hours to process the check.

- Your bank takes another 3-6 business days to deposit the amount.

- You can now instantly withdraw or transfer the money.

So, instead of waiting days to receive payments, you can consider using an option like Interac. This popular online banking network uses secure systems to process payment transfers instantly. You may wait up to 30 minutes at most, which is still fast enough. The most popular Interac product for iGaming is called Gigadat. If speed is really of the utmost importance to you, payments via e-wallets and cryptocurrencies are even faster. Plus, these options offer 24/7/365 transaction availability.

4. Risk of Interception and Information Theft

Cybercrime continues to be a challenge in Canada, due to most payments being processed online. The latest cybersecurity statistics show that Canadians were victims of over 41,000 cybercrimes in the first half of last year. Even more worrying is that 56% of those online crimes were associated with fraud.

Electronic check payments often involve sharing vital banking information. This makes them the ideal target for online attacks. Attackers can use social engineering techniques to trick you into providing your bank account details and use them to commit fraud. Misplaced eCheck banking information and account passwords also contribute significantly to online fraud.

On the bright side, eCheck payments come with a key security; merchants never gain complete access to your banking information. All you need to provide are your checking account details and address. The eCheck is sent directly to the bank, ensuring your sensitive information stays out of the recipient’s hands.

I think this one comes down to common sense. Would you walk closer to strangers in a dark alley? In real life, we have bodyguards, but online, we have firewalls. I highly recommend that people at least install a basic antivirus program (Kaspersky is good) along with a quality malware scanner like Malwarebytes. You never know what might “bite” you online (pun intended). Always-on firewall tools are truly lifesavers—some are so advanced that even if you click a malicious link, they can block the action and send you a warning. Personally, I’m a bit paranoid, so I always have spyware, malware, and antivirus programs running in the background. I feel like they’ve got my back, so I can focus on writing—which is all I care about. . – Dana Nikolic

To further secure your eCheck transactions, as a user, here are some tips to follow:

- Create a strong bank account password and change it regularly.

- Enable multi-factor authentication (MFA) for an extra security layer.

- Only use secure, password-protected Wi-Fi networks to initiate transactions.

- Don’t initiate eCheck transactions on unencrypted or malicious websites.

- Verify customer information before receiving eCheck payments.

- Regularly update your device and browser applications with the latest security patches.

5. Lack of International Standardization and Acceptance

One of the drawbacks of using eCheck is the lack of international acceptance. According to PayPal, eChecks are primarily designed for domestic use. This means international transfers via this payment method can be problematic. ACH and eCheck systems are usually ring-fenced to specific regions, with one side of the “fence” in the USA and the other in Canada. That’s why most offshore online casinos rarely process electronic check payments.

As we explained previously, eCheck payments in Canada rely on EFT systems, while in the US, they use ACH networks. Although both terms can be interchangeable, there are some slight differences. ACH connects bank accounts directly, while EFT is used for account-to-account payments. And they come with clear (domestic only) geo-restrictions.

There are several solutions to process international payments. An example is Western Union, a reliable money transfer service in 200+ countries. Keep in mind that transfers can attract a fee of between 1% and 6%. On the other hand, e-wallets like PayPal and Skrill offer a faster and more secure way to transfer money instantly across borders.

Just remember that Checks are typically ring-fenced for domestic use, primarily between the U.S. and Canada, making cross-border transactions with this method close to impossible.

For the younger and tech-savvy generation, cryptocurrencies like Bitcoin, Ethereum, and Dogecoin are another solid alternative. Unlike fiat currencies cryptos are decentralized public assets. Transactions are recorded on a public blockchain and this ensures transparency and security.

To get started with Web 3.0, we recommend setting up a secure crypto wallet.

6. Over Reliance on Electronic Infrastructure and Technical Failure

As mentioned earlier, eCheck payments rely on ACH/EFT, an automated electronic funds transfer system to clear and process payments. This network processes all eCheck debit and credit transactions and also manages huge volumes of transactions. An example is Nacha’s Same Day ACH, which recorded a massive 67% more transactions in Q3 of 2024.

However, as effective as they are, ACH networks sometimes fail, just like any electronic funds transfer system. And this is more likely to happen during times of peak use, much like a server that isn’t equipped to handle a sudden influx of traffic. A relevant example would be Black Friday, when retailers are bombarded with eCheck payments. At worst, the overall EFT system might go down (although this is quite rare); and at best, your eCheck will be queued as they sort through all the other e-Check orders one by one. On a smaller scale, the increased demand for electronic checks in Canada can lead to ‘errors’ like software glitches and server downtimes. It’s also clear that these systems require regular maintenance, which lead to temporary scheduled downtimes.

When ACH failures happen, businesses may experience payment delays or even losses. Therefore, having a contingency plan for any eventuality is important. A company can assess its payment systems to identify potential weaknesses and address them or source for third-party ACH services. Accepting payment alternatives like Check by Courier and Bank Wire is also a solution.

“As a hobby photographer, I always check out Black Friday deals at B&H, but I’ve learned not to rely on eChecks during busy times. With so many payments being processed, the EFT network in Canada can slow down, and I don’t want to risk my order being delayed. I stick with credit cards—it’s faster and more reliable for grabbing the gear I need. Plus, it looks like B&H no longer accepts PayPal eChecks, maybe for this very reason.” — Trevor

7. Potential Errors in Automated Systems

While ACH systems are generally reliable, errors can occur due to human mistakes. Failure to cross-check payments may sometimes lead to rejected checks and expensive business losses. Your check could fall into the wrong hands if you don’t use the correct account number. And remember, receiving a refund can be time-consuming and expensive.

An ACH system could return an ‘error’ message if there’s insufficient money in the sender’s bank account. Payments may also fail to go through due to invalid account information or using a closed/suspended account. Even minor errors such as entering the wrong entry date can give you an error message.

Below are a few codes that may indicate a technical failure:

- R02: A closed account

- R04: An invalid account number

- R20: Non-transaction account

- R24: A duplicated entry

- R28: Routing number check digit error

The good news is that human errors in ACH transactions are avoidable. You can reduce delays by making sure your eCheck account details match the bank information. In addition, make sure your bank account has enough funds to send an eCheck. The last thing you want is an expensive chargeback. And yes, contact the bank in case of any unusual payment delays. It could be something that the bank can resolve over the phone. You can find more information about Canadian banks that support eCheck here, as this will affect your depositing outcomes.

Conclusion

It’s a dangerous world for an iGamer out there. That’s why adopting simple safety measures, such as the ones mentioned in this article, can go a long way. We hope this piece has informed you and encouraged you to brave it out and achieve your iGaming goals. With due diligence and awareness, electronic checks can be a reliable and secure payment option. Good luck!