I’ve spent more than a decade gambling for real money at Canadian online casinos. In all that time, I’ve learned a thing or two about how to (and how not to) deposit and withdraw my funds. Some methods are faster than others. Some are more secure. A few can be used for both deposits and withdrawals, whereas others cannot. And some are just plain easier to use. Through it all, I’ve found that only eCheck casino deposits seem to tick all those categorical checkboxes.

I’ve spent more than a decade gambling for real money at Canadian online casinos. In all that time, I’ve learned a thing or two about how to (and how not to) deposit and withdraw my funds. Some methods are faster than others. Some are more secure. A few can be used for both deposits and withdrawals, whereas others cannot. And some are just plain easier to use. Through it all, I’ve found that only eCheck casino deposits seem to tick all those categorical checkboxes.

eCheck deposits are instant, just like credit cards, but without all the restrictions. With a credit card, you can only withdraw up to the amount deposited from that card. eChecks are as easy as bank wire transfers, but you’ll pay no fees. They are as secure as cash transfers, but there’s no hassle involved (and again, no fees).

Simply put, anyone with a Canadian bank account would do well to limit their funding to eCheck casino deposits and withdrawals. If your interest is piqued, keep reading. I’ll tell you all about them.

What Are eChecks?

The term eCheck is short for Electronic Check. They also go by the names Instant Check, Instant eCheck, EFT, and sometimes ACH). No matter the moniker, each is processed in the exact same way – the very same as a paper check, minus the time and physical presence of paper.

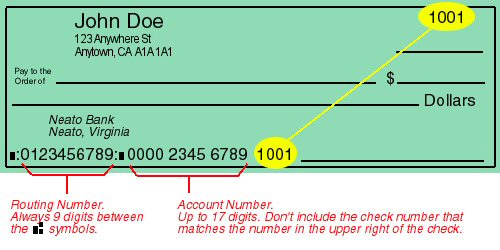

If you have paper checks, writing an eCheck is that much easier. Simply input the information from your check into the input boxes. You may or may not need the Check#. You’ll definitely need your Account#, plus the Bank’s Routing#. They’re all pointed out in the image below. If you don’t have a paper check, call your bank and ask. They’ll happily provide all the numbers you need.

Essentially, you are writing out a check on your computer, rather than with a pen.

Why not just send a paper check?

Good question, but with an obvious answer. Paper checks have to go through the mail… conventional mail… snail mail, as we call it, and with good reason. A paper check would eliminate the expedience of an eCheck. And because eChecks are immediately verifiable (i.e. it takes only a few seconds for the casino to confirm there’s enough money in your bank account), that means the funds can be credited to any Canadian eCheck casino in under a minute.

How Secure are eChecks?

For me – and I’m sure for all you readers out there – security is the number one concern when moving money online. So, to answer this question, we must look at who handles the facilitation of an eCheck deposit.

For me – and I’m sure for all you readers out there – security is the number one concern when moving money online. So, to answer this question, we must look at who handles the facilitation of an eCheck deposit.

First, we have the user’s bank; a government-regulated facility. If the bank isn’t secure enough to process an eCheck, who is? You can learn more about the technology behind mobile banking here.

Next, we have the online casino operator receiving the deposit. They don’t process payments directly. They utilize a third-party payment processing company. While it’s more difficult for a player to determine whether an operator and its processor are secure, we can refer to the integrity of the operator’s regulatory authority.

When an iGaming website is regulated in Ontario, that operator and all of its associated vendors/suppliers must adhere to the strictest government-mandated guidelines. Those guidelines require the same level of security as – you guessed it – government banks.

It’s also worth noting that Canadian banks will not process an eCheck to/from any website that does not incorporate secure SSL data encryption. With that in mind, if ever an eCheck casino deposit is rejected by your bank, you might want to consider finding a more reputable operator to do business with. Food for thought…

Tutorial On How to Make an eCheck Deposit at Spin Casino

Follow these simple steps to securely fund your account using eCheck:

- Go to Spincasino.com and log into your account

- Click on “Deposit” and select eCheck as your payment method

- Enter your bank account details:

- Account holder name

- Bank transit number

- Institution number

- Account number

- Enter the eCheck amount you wish to deposit

- Review and confirm your deposit details

- Accept the terms and conditions

- Click “Submit”

That’s it! The amount should instantly show in your account balance. However, withdrawal times vary:

How Long Are eCheck Withdrawals?

To be perfectly honest, an eCheck withdrawal can take “up to two weeks”. Before you scoff and click away from this page, let me break that down. The wait time for an eCheck withdrawal can be anywhere from 3 to 7 days. That’s after your casino processes the payout, which usually takes 24-48 hours. So realistically, you’re looking at 4 to 9 days. but those are business days only, which pushes it back to 4-14 days – or “up to two weeks”.

To be perfectly honest, an eCheck withdrawal can take “up to two weeks”. Before you scoff and click away from this page, let me break that down. The wait time for an eCheck withdrawal can be anywhere from 3 to 7 days. That’s after your casino processes the payout, which usually takes 24-48 hours. So realistically, you’re looking at 4 to 9 days. but those are business days only, which pushes it back to 4-14 days – or “up to two weeks”.

I know that sounds like a long time, and it is, but there are a few things you should consider.

The most common withdrawal options are paper check and bank transfer. Paper check – snail mail! – that’s gonna take at least a couple of weeks. Plus you have to wait for the check to clear your bank when you deposit it.

Bank transfers are quicker, averaging 3 days (after the casino’s 24-48hr pending period). But you’re going to lose a chunk of your payout by way of bank fees.

Web wallets are pretty quick, on the surface. You’ll get the payout in your eWallet as soon as the casino processes and releases the funds. But then you still have to send it on to your bank, which takes another 3 days or so, – unless you want to pay for a faster transfer.

The truth is, there’s no such thing as a quick payout. Unless you’re a super-high-roller with a VIP account manager and special perks, you’re going to be waiting a few days, at least.

Why does “processing” take so long?

Casinos like to wait a few days to process any cashout request. It’s not because they have to. At least, most of the time it’s not.

The only time it should take this long is when verifying a player’s details. Identity verification is no joke. It’s required by law, and every reputable operator will enforce it. Verification protects the player from fraud and keeps operators in compliance with anti-money laundering laws. But verification is a one-and-done process. After that one time – after that first withdrawal is completed – you’re smooth sailing.

From that point on, however, you’ll still have to deal with the pending period almost all operators implement before processing a payment. They will tell you that this period of time is used to verify the player’s eligibility to withdraw funds. But let’s remember, we live in a digital world, where things happen at the speed of taps and clicks. The moment you submit a payout request, it can be digitally verified, approved, and processed. But it won’t be, and I’ll tell you why.

Take a moment to read the fine print for cashouts and you’ll notice there’s always one line of text that says something to the effect of: ‘During process pending, you are welcome to reverse your withdrawal back into your balance at any time’. The casino would love for you to do that. Drop that cash back in your account and keep on playing. And they’ll give you 24-48 hours to think about doing just that before they give you your money.

No matter what payout method you choose, you will be waiting some time to get it. At least with an eCheck, you know it’s safe and secure. And because you’ve already used an eCheck to deposit (that’s another requirement), you know the money is coming to the right place.

And This Is All Free?

eCheck casino deposits are always free. Again, they mimic paper checks. Were you ever charged a fee for writing out a paper check? Of course not. Well, not unless it bounced, but that’s another beauty of eChecks. They are instantly verified, so you can’t bounce them. If you don’t have enough funds to cover it, the bank will simply reject the payment. There’s no charge for trying.

Before I get ahead of myself, there is a small chance casinos will charge a fee for eCheck withdrawals. Your bank will not, but some casinos might. Generally, they will only charge if the withdrawal is for a small amount. More likely, they will impose minimum eCheck cashout limitations so they don’t need to charge for it. You’ll want to look for things like this on your casino’s cashier page. For example, you may be limited to free eCheck payouts of $100+.

Rule of Thumb : Always check the terms, wait period, and fee schedule for any payment method before making a decision.